30-12 months versus. 40-12 months Home loan: A summary

You to very important concern to address when you are making an application for a home loan is where long new repayment identity are. Going for a 30-season vs. 40-seasons mortgage often apply at your monthly installments and how far desire you can easily pay from inside the totalparing for every single home loan choice helps you determine hence mortgage title helps make the most feel for your requirements.

Secret Takeaways

- Lenders may offer numerous financial terms and conditions, plus 30- and you can forty-12 months mortgages.

- Going for a thirty-seasons mortgage often means a top payment per month however, help you save cash on need for the near future.

- However, with an excellent 40-year financial, your monthly installments would be lower but the overall level of desire you’ll be able to spend would be high.

- Having fun with a mortgage calculator ‘s the simplest way so you can guess just what you could pay for a 30-year against. 40-season mortgage, not all the calculators day in terms of 40 years.

30-Seasons compared to. 40-Season Home loan: Key Distinctions

/images/2024/06/07/customer-inserting-card-into-credit-card-reader.png)

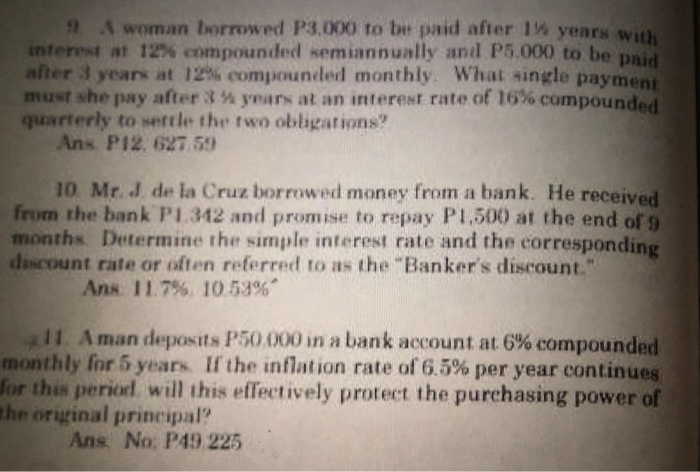

In addition to the lifetime you only pay on the the loan, there are more features you to definitely separate 31-year and you may forty-year mortgage loans. Here is how evaluate them immediately.

Multiple affairs influence the quantity you’ll be able to shell out per month on the financial, and just how much your acquire, the newest loan’s rate of interest, together with term (or length) of your own financing. Choosing an excellent forty-year financial contributes a separate 10 years out of repayments into loan but reduces the amount you’ll be able to pay month-to-month.

Suppose you can buy a $350,000 mortgage at the 7.25%. Here is how the latest monthly obligations create compare to every type out-of financing, including prominent and you will focus:

- 30-seasons name: $dos,388 thirty days

- 40-12 months term: $2,238 1 month

That is a change regarding $150 a month, which is a little currency otherwise too much to you, according to the money you owe.

Note that these calculations never take into account individual mortgage insurance (PMI), possessions taxation, or home insurance. Each of those individuals will add to the monthly financial statement if the you have to pay in their mind through an escrow account with your bank otherwise financing servicer.

Overall Notice Repaid Research

If you find yourself going for an extended loan title can reduce their monthly obligations, it will increase the amount of appeal you pay over time. This is how much interest you would spend toward a $350,000 mortgage on 7.25% with a thirty-season against. 40-12 months term. Each other data suppose a predetermined mortgage rate and that you hold the mortgage for its entire name.

- 30-seasons name: $509,542 in total notice

- 40-season name: $724,649 overall attention

Choosing an effective 40-year financial would cost you a supplementary $215,107 from inside the appeal, so long as you don’t re-finance so you can a lesser rates otherwise build a lot more money into the primary.

Loan Name Comparison

If this is sensible to blow towards home financing having an additional a decade can depend on your own decades and you will monetary state.

By taking away a great 40-12 months financial on decades 31, you’ll have they repaid by ages 70, and this can be inside the go out you propose to retire. As well, if you wait until age 40 to purchase our home you will be now using towards financial unless you change 80.

That will not be best for individuals who invited a life threatening prevention when you look at the income otherwise an increase in costs when you personal loan Carolina retire. A thirty-seasons loan label would allow that clear the mortgage obligations sooner or later, that’ll slow down the strain on retirement budget.

Interest Evaluation

You might believe that an extended loan term will allow you to take benefit of a lowered interest rate. At all, the financial institution has already been planning to assemble attract costs away from you for a longer time therefore the pricing are lower, correct?