A good Citi Fold Loan lets eligible Citi cardmembers move part of the credit card account’s borrowing limit to the a consumer loan. You can shell out the loan of in fixed monthly obligations with both a fixed interest and you can fixed agenda (around sixty months) which means you know precisely whenever you’re going to be clear of loans. You may also personalize such terms within the mortgage processes.

Citi cannot charges one independent charge to get going besides the interest, even if avoidable charges, including late charge of this your bank installment loans in Philadelphia account, ount you could borrow that have a great Citi Fold Financing is actually $five-hundred, together with limit depends on your income, credit limit and extra issues you to incorporate once you request brand new mortgage.

Once you have complete the process, you might discovered their loans via lead deposit inside the as little all together so you’re able to a couple business days otherwise request a papers evaluate (which may take-up to ten working days to get).

Because you pay-off the Citi Fold Mortgage, you might not have to make an extra commission per month; the amount owed on the account will include one another their borrowing from the bank card’s minimum payment due in addition to repaired payment for your Citi Fold Loan. You could will pay more than minimal at any date, and there’s no prepayment punishment used for people who spend your stability out-of very early. Additionally you doesn’t earn credit card benefits on the loan.

Taking right out an excellent Citi Flex Financing has the possibility so you can feeling your credit score into the a bad way. The mortgage increases the portion of borrowing from the bank utilization, which makes up 30 percent of your FICO credit score, by increasing the complete count your debt. Masters highly recommend keepin constantly your full number due below 30 percent away from the available borrowing.

And increase your own credit usage can damage your own get, the initial component that accounts for the FICO Get is payment records, bookkeeping to own thirty five percent. Because of this you could potentially run improving your credit history by creating fast payments in full each month. Since your borrowing from the bank utilization drops, your credit score also can raise.

Where to find aside if you find yourself qualified to receive a beneficial Citi Flex Mortgage

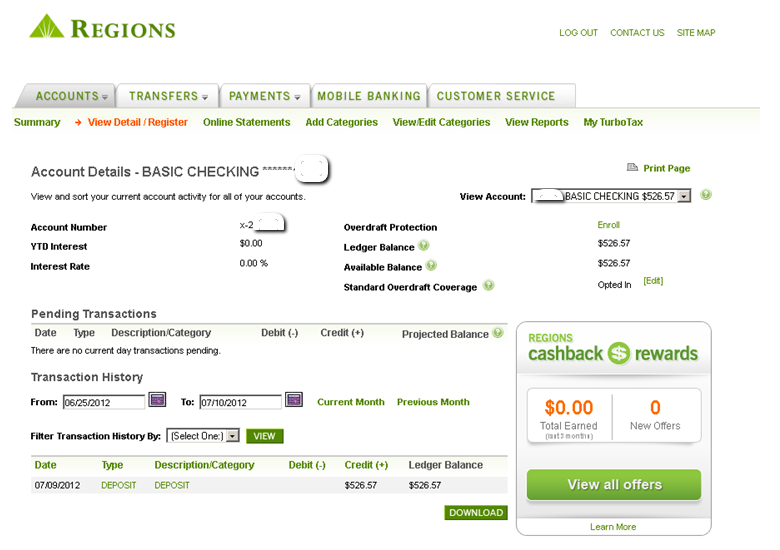

Predicated on Citi, cardholders can also be find out if they’re eligible for a beneficial Citi Fold Mortgage by the logging in in order to an internet Citi account. Citi Bend Mortgage has the benefit of is generally exhibited on the Account Evaluation page, or if you is able to glance at available also offers by the selecting the fresh new Services/Mastercard Attributes solution at the top of the fresh new web page.

Benefits associated with Citi Flex Financing

- You don’t have to apply for so much more borrowing from the bank; hence, there will be no difficult query on the credit report.

- Such fund usually do not come with people fees, including the high priced origination charge specific signature loans charge.

- It is possible to be eligible for a reasonable Annual percentage rate that helps it will save you currency over time.

- You may be already regarding Citi program and approved to possess a column away from credit, which means you won’t have to experience a long techniques or fill in the full loan application to begin.

- There are not any undetectable charge, in addition to no prepayment penalties.

Drawbacks out of Citi Bend Financing

- You do not secure charge card perks, and cash back otherwise rewards items, for the Citi Flex Fund.

- Citi Fold Fund can come which have a top interest rate than just you may get having a consumer loan.

- Rates of interest towards Citi Flex Finance are definitely greater than your get having playing cards that offer an excellent 0 percent Annual percentage rate for the orders getting a restricted go out.

- This type of financing can lead to bad impacts for the credit rating in the event the the usage increases past an acceptable limit.