Maurie Backman is your own loans copywriter which covers subject areas ranging regarding Public Security to credit cards to mortgages so you’re able to REITs. She has an editing record and seems towards the real time podcasts to share financial things.

Robin Hartill, CFP, is the Ascent’s Head of Unit Evaluations and has now worked for The fresh Motley Fool as the 2020. Their particular really works has appeared in various federal courses, also Bing! Fund, NerdWallet, Investopedia, CNN Underscored, MSNBC, United states of america Now, and you will CNET Currency. She in past times wrote The Cent Hoarder’s syndicated Dear Penny private funds information line. The woman is situated in St. Petersburg, Fl.

Eric McWhinnie could have been creating and you may editing electronic content while the 2010. The guy focuses on personal finance and you will paying. He as well as retains a beneficial bachelor’s knowledge for the Finance.

There are many good reasons to acquire a property these types of weeks. While however operating remotely, you have an even more flexible business schedule, to manufacture it more straightforward to extent out belongings and you will bargain along with your financial app. Given that financial rates features mounted and you may home prices are higher, to purchase a house today is sometimes difficulty.

But what whenever you are applying for a mortgage as one with a great mate, as well as their credit history can use some performs? Do you actually be eligible for a mortgage if for example the credit score was solid, your partner’s isn’t really?

In case your wife or husband’s credit rating requires functions

You can think that in the event your credit history is superb, your partner’s is not, mortgage lenders will simply average your a couple scores and you can squeeze into that amount. But that is not really how it functions.

Your own solid borrowing from the bank may help compensate for a wife or husband’s poor credit to some extent. But ultimately, loan providers have a tendency to fixate into down of the two score in the event the you are trying to get a mortgage together.

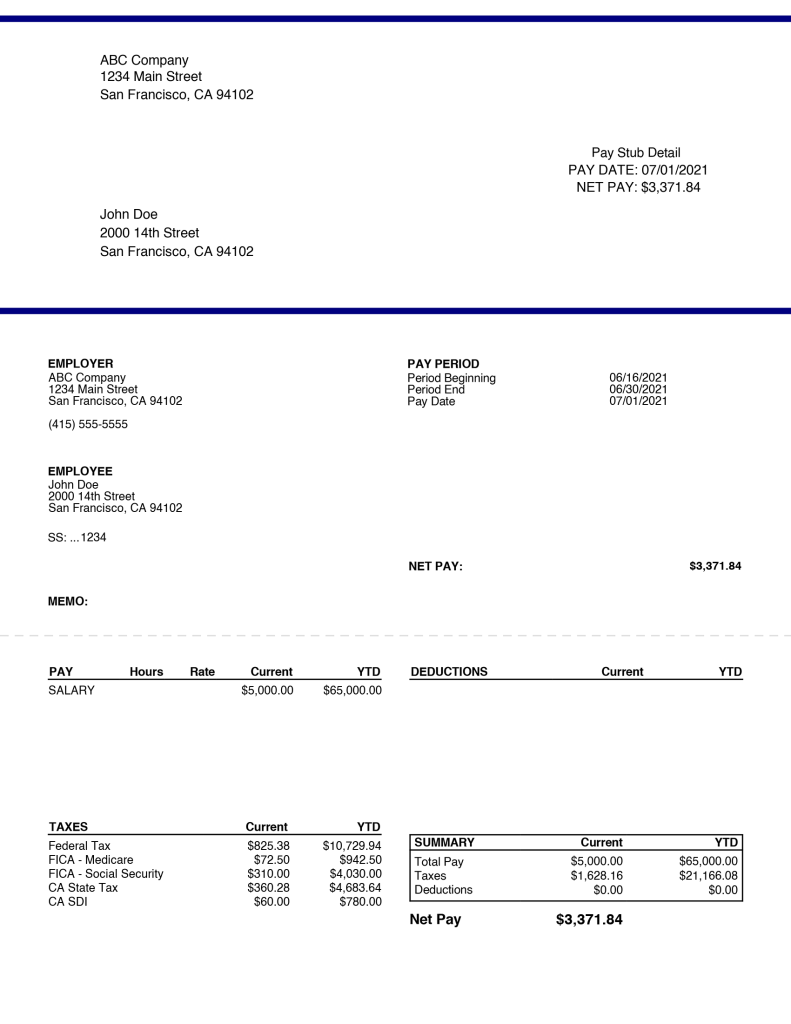

Loan providers have a tendency to remove fico scores for both candidates off each of the three biggest bureaus. They make use of the “straight down middle score.”

Imagine your around three credit ratings is 787, 790, and you can 802. Your own center score are 790. Your own wife or husband’s credit ratings is actually 608, 620, and you may 627.

An effective 790 is a great credit history. However, a 620 is often the lowest credit history needed for a home loan, thus within this scenario, you can find acknowledged getting a mortgage without any very aggressive rate of interest with it.

Likewise, if your rating is actually good 790 however your partner keeps a 540, you to reduced get could potentially wreck your chances of bringing approved having a mortgage, even with your own great credit.

In the event that you sign up for a home loan solo in the event the spouse keeps poor credit?

Whenever there is certainly a huge gap between the (strong) credit history and your wife or husband’s, one service could be to make an application for home financing on your own individual rather than incorporate together with your spouse. This may merely work, although, for those who secure adequate money to pay for the homes costs with the the.

As well as credit ratings, lenders will look at your income to see if it’s higher adequate to qualify for the borrowed funds you happen to be seeking to. Whether your earnings isn’t high enough so you can snag one to mortgage, and also you you want the wife or husband’s earnings factored with the formula, then you’ll definitely have to sign up for financing together. That’s in the event your partner’s bad credit could well be a challenge.

Unfortunately, you simply cannot obtain it each other implies. You can’t matter your spouse’s earnings on your own application, although not their credit history.

Tips let your own partner’s credit improve

For those who have a wife whoever borrowing requires functions, this may spend to carry one number up-and up coming apply to own a mortgage. First, get spouse score a copy of its credit file to see just what it seems like. In the event the you can find problems thereon claim that performs up against their companion, fixing them you certainly will enhance their get rapidly.

Next payday loan Eldora, understand why your partner’s get is really so lower. Will it be on account of a belated payment history? A lot of credit card debt? If the discover delinquencies in your wife or husband’s credit score, it may help rating latest with the the individuals money, following spend punctually from there onward. Likewise, repaying an enormous amount regarding established debt may help your own wife or husband’s get increase.

In some cases, applying for a home loan also a partner sets you within a bonus — specifically, you’ll have two groups of earnings to provide in order to loan providers. But the flipside would be the fact you can each other you would like a good credit score to help you snag an easily affordable home loan rates. If your spouse’s credit history is actually poor, it could prove tricky. Determine a backup bundle, whether it’s applying for a home loan yourself or delivering steps to create the spouse’s rating up easily before submission their app.

Continue to have issues?

If you want to find out more about an informed lenders to possess reduced costs and you can charges, our very own positives have created an effective shortlist of one’s best home loan organizations. A number of all of our pros have utilized these lenders themselves to help you clipped its will cost you.

- Perform loan providers look at each other spouses’ fico scores once you use to have a mortgage?

While making an application for a combined mortgage, loan providers commonly thought all of your own credit ratings. Of several often eliminate score for spouses off all the around three credit bureaus and make use of the middle rating towards partner towards the all the way down results. If perhaps you to definitely lover applies towards the home loan, just its credit scores could well be sensed.

Zero. Your credit rating is founded on your personal credit rating, maybe not their wife or husband’s. Although not, for people who jointly apply for a mortgage or other sorts of loan, both of your own credit scores will be felt.

Repaying a good number of credit card debt helps you improve rating quickly since you lower your borrowing utilization proportion, or even the complete level of credit you might be playing with. Repaying a loan provides faster impression because doesn’t apply at credit utilization. While making towards the-time costs to own handmade cards and funds will assist their get, however the impact was gradual. If you don’t have discover borrowing and cannot become approved to own credit cards, obtaining a secured bank card can also help.