Learning to get pre-recognized for home financing during the Seattle will be easy. After all, you can’t move a handbag nowadays as opposed to striking a bona fide estate top-notch otherwise viewing a number of online lenders promising very-reduced rates and you may reduced-prices money. Sadly, many of these online businesses take advantage of an uninformed and you will uneducated home customer. Home buyers whom end up working with any of these lenders discover that he or she is strike which have higher fees and you can costs than just assured and so are kept wringing its give hoping its mortgage commonly intimate promptly or whatsoever. Inside book on how best to score pre-recognized to possess a home loan when you look at the Seattle, we will falter the actions. So we has a good freebie make suggestions can use whenever it is time to select that loan representative and also pre-approved!

First, So what does They Mean is Pre-Approved for a loan into the a property?

Becoming pre-approved to have home financing implies that a lender/ standard bank possess formally assessed your financial recommendations and you may figured you have: the cash (without expenses) buying a property, savings in case some thing happens to one to family, and you can a credit score one to shows that you have a last regarding investing your financial situation (credit cards, student education loans, etc..) several times a day.

Very homebuyers you prefer a lender to give all of them currency to shop for a home. Definition you’ll receive a home loan. Finance companies are around most rigorous guidance into whom qualifies for a great home loan based on the credit ratings, extent they need to put down into a home, and the status of the house. Good bank commonly take you step-by-step through the entire techniques and you can provide the guidance you should get pre-accepted. It is attending become your bank account and sort of residential property one be considered. Yes, property must also getting lendable aka approved for a financial loan.

We wrote a site not long ago that will supply you with with many more information because you begin the whole process of providing pre-approved for a financial loan and you can carrying out generational wealth by the getting a good family. Here are a few Getting your Financial Financial support So a home Purchase.

Actions about how to Get Pre-Approved to have a mortgage during the Seattle

- Correspond with 2-step 3 Necessary Mortgage Professionals

- Buy the Financial Who is able to Become a good fit To you personally

- Understand the Difference between Pre-Certification, Pre-Accepted, and Underwritten Recognized

- What exactly is Your credit score?

- Decide how Much You need/Has to have a downpayment for a mortgage

- Understand how Far Need getting Closing costs to possess a property Financing

- Make a discount Policy for The Down payment and you will Closing costs

- Get the Credit in Tip top Figure locate Pre-Accepted getting a mortgage for the Seattle

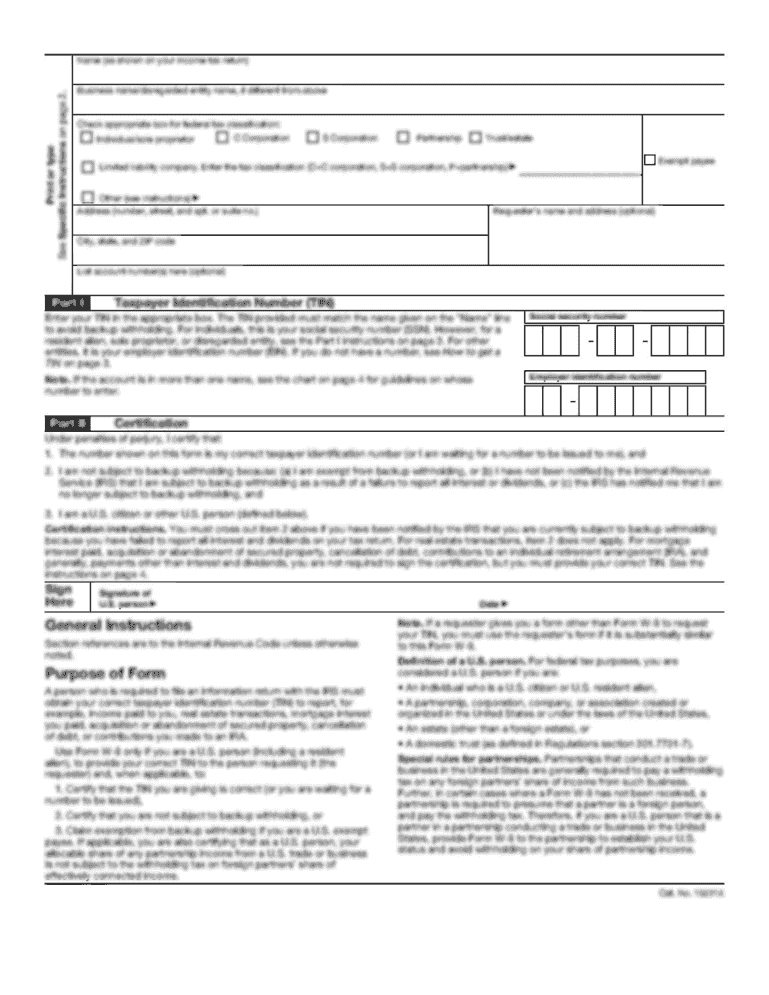

- Collect Your financial Data files

- Make sure you are Pre-Acknowledged As a consequence of Underwriting

Pro-Tip: Speak to your favourite real estate agent to discover just who they prefer to work alongside to possess a loan provider. Generally these lenders be much more adept from the talking about regional markets facts or uncommon home financing facts.

A full Guide about how to Rating Pre-Recognized to possess a mortgage from inside the Seattle

The initial step to buying a house ‘s the pre-acceptance processes. In the current erratic credit sector becoming pre-approved is extremely important. So what does becoming pre-acknowledged most loan places Smoke Rise suggest? It indicates you to definitely according to your loan app, financial status, and you can fico scores a lender has given a true commitment to financing your loan as much as a certain rates. Generally speaking, when you are pre-accepted, you are nearly certain of delivering financing considering you will find no biggest changes in debt condition (we.age. loss of a position otherwise lower fico scores).