Assumability

Whenever a homeowner just who ordered their residence as a result of a keen FHA mortgage wishes to sell to a different people, FHA loan guidelines let the brand new proprietor when deciding to take along the home loan repayments owed of the very first manager. This feature can result in thousands of dollars during the offers into the closure cost of the order towards the brand new customer.

The customer get take pleasure in far lower interest rates than they’d have to pay towards the a separate financial, and you may suppliers you are going to promote their homes shorter than simply they or even might was indeed in a position to.

Disadvantages off Taking out fully FHA Money

When you are there may be an abundance of benefits to FHA funds, they aren’t a perfect complement group. You’ll find drawbacks too. When selecting anywhere between traditional and you can FHA money, these types of negative items are very important to consider.

Need Restrictions

The latest FHA finance have limitations in what borrowers can purchase, that do not exist that have conventional money. You simply can’t, such, play with FHA financing to invest in financing characteristics or 2nd land.

The fresh logic at the rear of such restrictions should be to guarantee the intent behind this new FHA – making it easy for straight down in order to center-earnings earners to possess their residential property instead of improve the already wealthy gather a whole lot more.

Financial Insurance policies Costs

New premium payments one to individuals have to pay when they have FHA finance is relatively higher than individuals who feature antique money. These types of Home loan Insurance premiums (MIP) is recharged together with the annual superior, that’s usually 8.5% of mortgage equilibrium yet are paid down. The brand new MIPs try labelled on step one.75% of the loan’s complete number, which can be put in the mortgage or paid-in bucks and you will continue for this new loan’s existence.

Loan Restrictions

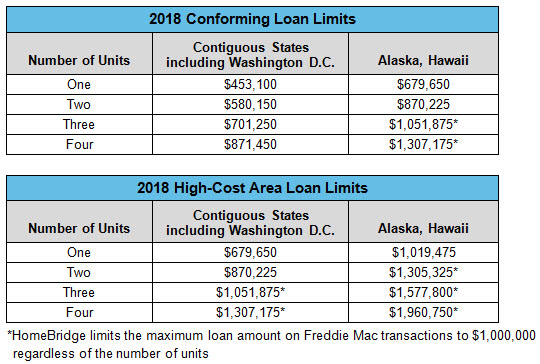

FHA financing exists to make it simple for people with more compact incomes getting their unique residential property. They may not be truth be told there to aid wealthy some one buy alot more mansions, so might there be restrictions on their mortgage systems. Different claims enjoys different financing limits based on their guidelines.

FHA Appraisal Process

To attain capital eligibility, one home up to possess money by the FHA must satisfy certain livability and you can coverage conditions. These appraisals are similar to all about home inspections, but these must be done by licensed FHA appraisers. These appraisers cost more than just important all about home inspections, and also the FHA insists into with these accomplished by their officials.

Paperwork Regularity

The program procedure for FHA money can be a bit more difficult than simply where old-fashioned financing are concerned. Individuals documents and you can variations have to be closed and filled out, lengthening the application process. These types of documents are made to include the borrowed funds candidate, making them worth the even more measures. This new FHA Amendatory Condition, such, alters the acquisition price and so the customer has the solution so you’re able to cancel the recommended get when your home doesn’t see the fresh new expected criteria following assessment is carried out.

Condominium Limitations

Discover restrictions toward kind of plans your FHA can get approve. The reality, in most instances, is that an intensive software needs to be published to the new HUD by the Homeowner’s Association (HOA) or associated human anatomy in advance of recognition is actually safeguarded for a task.

The brand new FHA will make an exclusion to possess just one-equipment endeavor inside a non-recognized advancement if for example the enterprise resource on the FHA cannot surpass 10% of your total investment pricing.

CAIVRS is a federal databases that lending establishments glance at up against just before approving bodies-backed loans. The device try a sign-up of all those who owe loan places Arley currency towards the bodies. These you will become people who have government liens on their property, court-mandated to invest the government, and those who features defaulted towards virtually any bodies-backed finance.