If you are looking purchasing a house in an outlying city and explore financial support choice having advantageous terms, USDA funds are going to be a possibilities.

On this page, we’re going to walk you through the huge benefits, qualification conditions, app techniques, and requirement for Rural Growth in Lafayette, Louisiana.

Insights USDA Loan Lafayette, Los angeles

The united states Agencies off Agriculture also provides home loan apps supported by USDA loans, also known as Rural Development finance. He is made to support homeowners within the outlying and suburban section through providing sensible funding that have reasonable-rates and versatile qualifications requirements.

Benefits associated with USDA Mortgage Lafayette, La

- 100% Financing: USDA finance allow it to be funding for your household cost, eliminating the necessity for a deposit. This is going to make homeownership way more possible for most people for the Lafayette.

- Competitive Rates of interest: That have USDA fund, consumers can enjoy aggressive interest rates which might be have a tendency to lower than conventional financing. Straight down interest rates translate to lower monthly home loan repayments, providing potential deals along side longevity of the loan.

- Versatile Credit Criteria: USDA loans has actually versatile borrowing criteria, which makes them accessible to people with smaller-than-best borrowing histories. Even if you have had borrowing from the bank pressures in earlier times, you might still be eligible for a great USDA loan for the Lafayette.

You can enjoy the advantages of homeownership with no weight away from a down payment, while also taking advantage of down monthly installments and deeper independence within the borrowing from the bank criteria

Outlying Innovation Funds during the Lafayette, La

The significance of Rural Development: Outlying innovation plays a vital role when you look at the Lafayette, La, and its surrounding areas. It is targeted on improving the lifestyle, infrastructure, and monetary opportunities when you look at the outlying groups.

- USDA Financing inside Lafayette: USDA loans are part of brand new rural creativity perform into the Lafayette. Giving reasonable financing selection, such fund contribute to the organization and you can balance away from outlying communities in your community. They activate financial pastime, foster society invention, and you can bring accessibility safe and sensible housing.

Becoming entitled to a good USDA financing for the Lafayette, you ought to meet specific requirements. Here are the trick criteria:

- Property Venue: The home you wish to get should be situated in an enthusiastic eligible rural or residential district city. You might determine the fresh new property’s eligibility because of the discussing the USDA qualifications map otherwise contacting a lender used to USDA funds.

- Money Limits: USDA money features money limitations according to the sized their domestic plus the location of the assets. Its crucial to review the modern income restrictions set by USDA to decide the qualifications. Such restrictions ensure that USDA financing try focused for the people and you will parents having reasonable in order to reasonable profits.

- Property Conditions: The house need fulfill certain protection, habitability, and you can sanitation conditions established because of the USDA. A qualified elite conducts an appraisal to test such conditions. It implies that the property brings a secure and you may appropriate traditions environment.

Meeting such requirements is important to help you being qualified having a beneficial USDA loan for the Lafayette. Ensuring that the house or property is in an eligible area, your revenue drops when you look at the given limitations, together with possessions match the mandatory conditions increases the possibility away from protecting a USDA loan. \

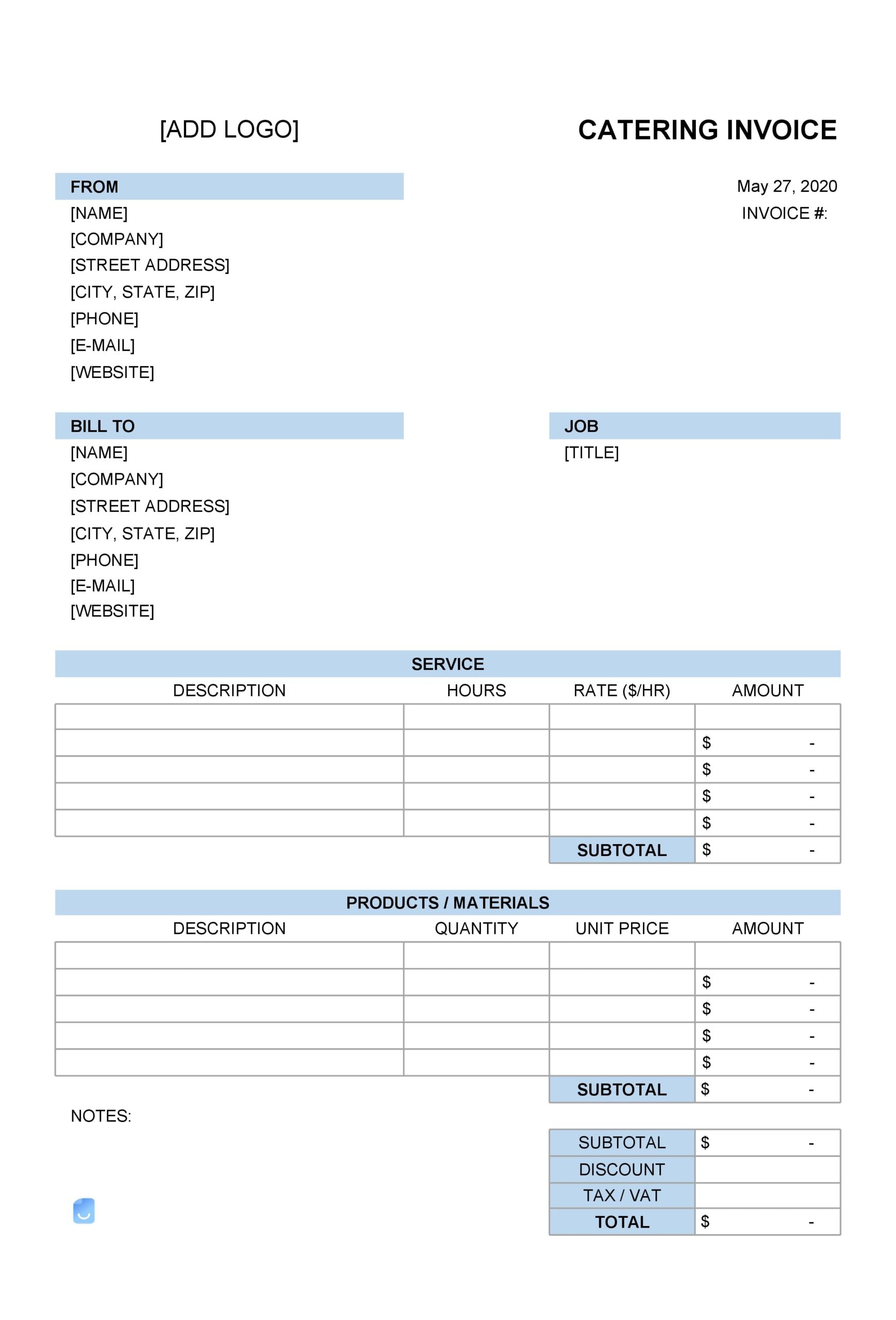

Making an application for a rural Innovation Loan inside Lafayette, La

- Trying to find a beneficial USDA-Approved Lender: To apply for a installment loans no credit check Richmond MO good USDA loan from inside the Lafayette, you’ll need to find good USDA-approved financial knowledgeable about these types of loans. They understand this requirements and papers needed for USDA financing software.

- Meeting Papers: Before you apply, assemble expected papers eg proof income, credit history, a career records, resource advice, and you may character.