31 Aug Got Poor credit? Provided Simple tips to Re-finance Your house Mortgage?

Refinancing a mortgage should be a smart financial circulate to have homeowners appearing to reduce their attention pricing, availability security, consolidate debt, or to switch this new regards to their home loan. As you may have to plunge thanks to a few additional hoops to obtain refinancing a mortgage that have poor credit, luckily you can still find selection. Have a look at a number of the reasons why homeowners choose refinancing a mortgage, and ways to re-finance NZ mortgage brokers which have less than perfect credit.

Reasons to re-finance which have poor credit

Which have less than perfect credit helps it be much harder to locate home loan acceptance when you refinance, however, that doesn’t mean it’s impossible. Of several Kiwis favor refinancing mortgage to possess:

- All the way down interest levels: With less than perfect credit, you’ve got initial safeguarded a mortgage within a top appeal rates of the seen likelihood of your loan. However, if your credit history provides enhanced since then, mortgage refinancing you can expect to will let you change your current financial that have an alternate that with an even more beneficial rate of interest, which could lower your mortgage repayments and you can save some costs during the the long run.

- Improved credit score: By refinancing their financial which have a less expensive mortgage payment count, you will be capable of making mortgage payments punctually and you may entirely. This allows one show responsible economic habits so you’re able to loan providers, and that, throughout the years, accelerates your credit rating and you can allows you to access significantly more favourable rates and you will terms and conditions in the future.

- Supply family security: Mortgage refinancing enables you to tap into the house’s equity, which is the difference in your own property’s latest value in addition to left harmony on the home loan. Security will bring entry to loans you can use to own family home improvements, instructional expenses, a holiday, or even doing a business. Utilising the collateral smartly , you might control your residence’s worth to alter your debts.

- Debt consolidation reduction: Refinancing your own home loan will bring a way to consolidate highest-attention obligations, eg credit debt, from the tapping into the fresh security of your property and you can increasing your financial proportions to repay people expenses. Debt consolidating will help clarify obligations and you can possibly safer good down interest as well as cost.

- Versatile loan terms: Refinancing a mortgage enables you to tailor your home mortgage to better fit your most recent requires and you can economic needs. Such as, you could potentially refinance to help you a lengthier-title repaired interest to offer way more balance into the focusing on how far your own mortgage repayments is having brand new near future. Or if you might wish to refinance and you https://speedycashloan.net/payday-loans-wv/ can shorten your loan term to pay off your property financing less.

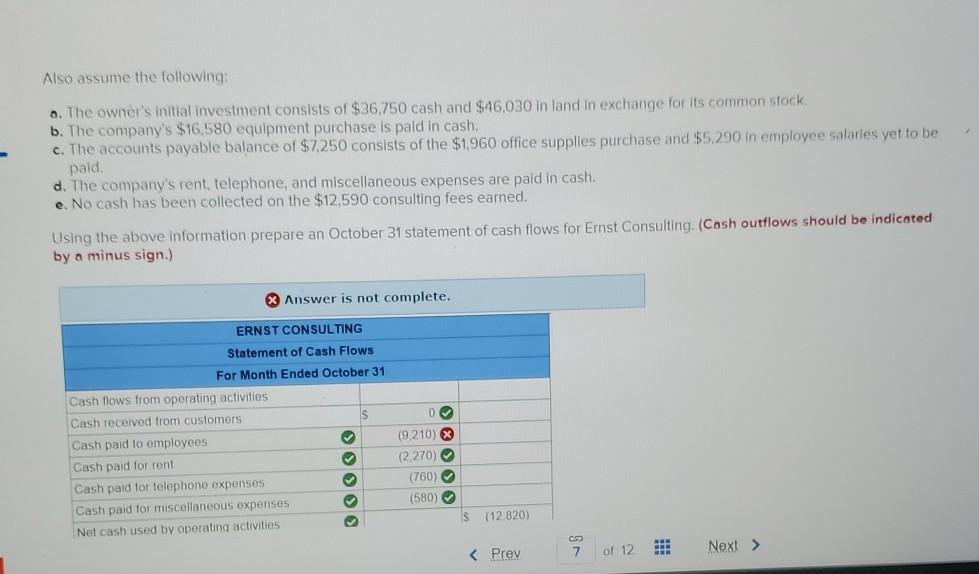

Simple tips to refinance which have poor credit

If you have battled which have a less than perfect credit rating due to economic adversity or a skipped commission previously, it is beneficial to remember that you can still find choices for mortgage refinancing. Stick to this action-by-step self-help guide to refinance a home loan which have poor credit:

- Determine your borrowing from the bank problem: In advance of dive into the refinancing mortgage processes, it’s important to take a look at your existing credit condition. Consult a duplicate of your credit file out-of a credit agency and you may comment it cautiously. Pay types of awareness of any mistakes otherwise inaccuracies which may be adversely affecting your credit rating and you will declaration these to the financing bureau getting all of them fixed.

- Improve your credit rating: Take the time to raise and reconstruct your credit rating. Understand items that can be adversely feeling their rating and avoid destroyed otherwise and work out later payments, making an application for borrowing constantly, otherwise trying out a lot more debt than simply you can afford.

- Talk about your residence financing solutions: Bad credit mortgage brokers are made to assist individuals having bad credit , whom may well not otherwise be eligible for a home loan with a main lender. Once the rates of interest into the a less than perfect credit financial may feel somewhat higher than antique lenders, he’s however competitive. While doing so, trying to repay less than perfect credit home loans can help alter your borrowing from the bank score so you’re able to re-finance later in order to way more beneficial rates of interest.

- Get assistance from home financing Adviser: Work on a skilled Financial Adviser who can help you navigate the causes regarding refinancing mortgage which have poor credit, and you may connect you on the proper bank thus you will be in hopes regarding triumph.

Rating professional advice throughout the mortgage refinancing

Mortgage refinancing is a big decision and it helps you to have the studies and you will advice of a home loan Agent like those at Maximum Mortgage loans. Working with a max Mortgages Agent will assist you to generate an educated choice on even when mortgage refinancing is great for you. Because i run a range of lenders all over NZ, and additionally one another banking companies and low-lender loan providers, Maximum Mortgage loans Advisers also provide refinancing a mortgage solutions to consumers with bad credit. Get in touch with the team today to talk to an effective Financial Agent regarding the mortgage refinancing with less than perfect credit.