Irrespective of where you’re on your residence capital travels, paying your residence loan shorter is a strategic flow that can change debt frame of mind

Stating so long so you’re able to obligations and achieving monetary independence is a lot easier when you have got fundamental steps as possible get at this time. Even in the event all these tips will bring you nearer to being able to bid farewell to your property mortgage ahead of plan, ensure that you demand financial experts so that you can personalize this type of tips to your unique activities:

Keep the welfare speed Begin your house-running journey because of the securing the essential favourable interest just at first. Look and you will compare lenders’ prices to ensure that you get the best bargain on your own financial, which will surely help your with the early settlement. Playing with a thread inventor such as BetterBond seems to simply help members have the very best deal on their financial. They’re going to score rates of all the biggest financial institutions on the behalf, saving you money and time.

Lifetime redesign Very carefully test thoroughly your paying patterns to determine the best place to scale back. Lookup carefully at the discretionary using: dining out, activity subscriptions, and you can reaction searching. By making smartly chosen options and you may prioritising your financial specifications, you can reroute those individuals savings on bond cost and reduce your residence mortgage.

Change your junk towards the somebody else’s benefits Embrace your own interior conservative and you can declutter to help you free your home of too many items that are collecting dust. Try not to toss all of them away, alternatively discuss on the internet markets and/or offer all of them through regional thrift communities to transform your former treasures to the cash that one can increase their Camp Hill loans bond fees.

Every absolutely nothing additional support All of the quick, additional share is important. Whenever you can, inject their month-to-month repayments that have an extra serving of devotion – though anything you are able is a supplementary R50 this few days. These a lot more number help incrementally processor chip aside from the prominent financial obligation, reducing the title on your mortgage and you will enabling you to spend less on appeal charge.

Turbocharge that have lump sums Grab those people unanticipated windfalls, such as for example a payment in the income tax people or an unexpected genetics, and changes them toward bond-slaying missiles. Spend some this money, be it every or section of your own yearly bonus or an excellent shock influx of cash, to your residence financing and view the a fantastic harmony dwindle and you will the interest charges diminish.

Improve assets work for you Perspiration your advantage that have a holiday hustle by renting your visitor place(s) while in the peak traveling and you may travel seasons (whenever you). In the event your property has twin way of life potential, thought maximising that and renting one place away because the small or long-title rooms. Regardless, so it even more income set in the bond might possibly be a game title-changer.

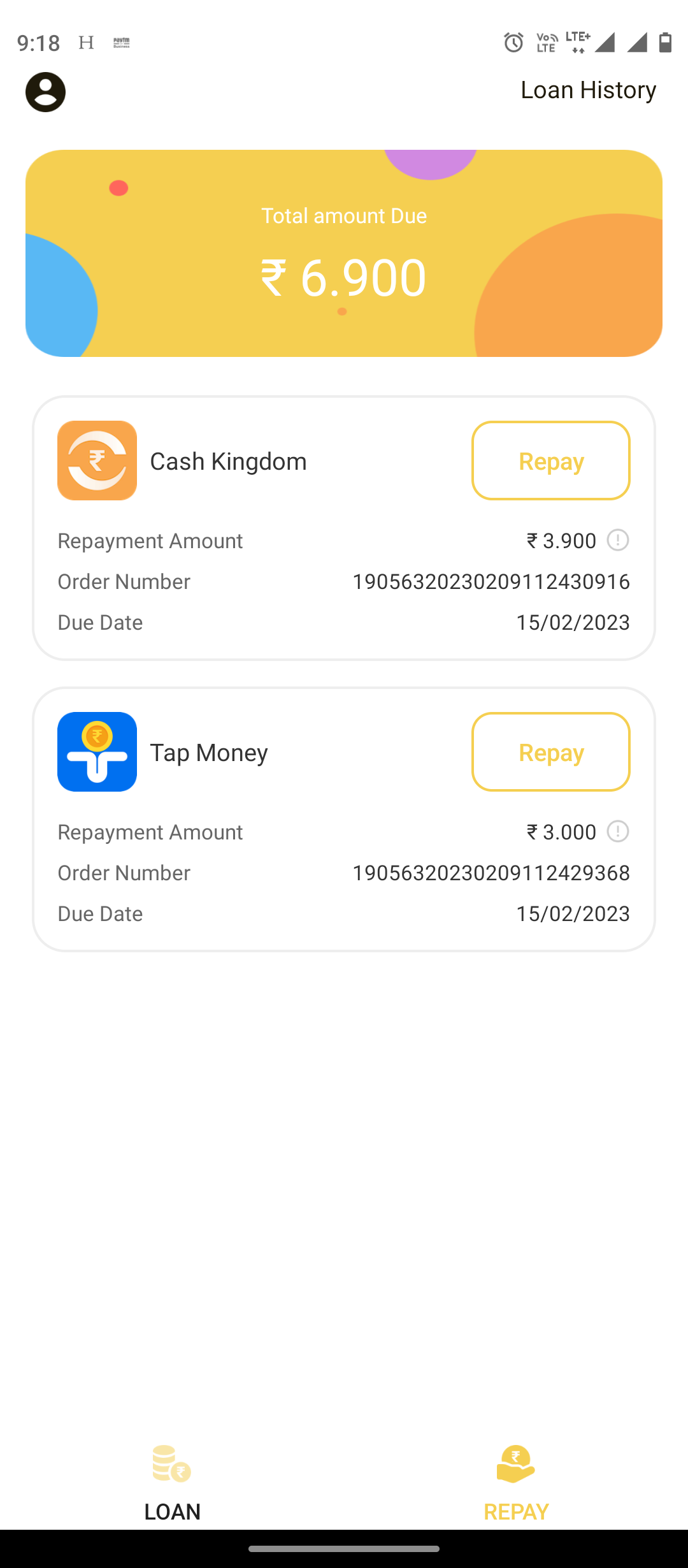

Combination channel While you are juggling numerous fund, just like your car loan and also other large-solution things, take a look at the the power of integration. However, there are advantages and disadvantages to that particular solution, so be sure to keep in touch with a professional economic expert ahead of choosing to wade this route.

Customized mortgage fees actions

Let’s mention a few of the options for different varieties of possessions residents, which could assist you to control the efficacy of very early bond settlement:

First-go out homebuyers Since a primary-time client, unlike purchasing rent, it’s always best to go into the house markets just too in lieu of slowing down the acquisition if you do not is pay for their permanently house. Pick an affordable admission-top domestic that see from inside the worthy of throughout the years which you are sure that you can afford to settle shorter. By doing this, the newest security that you create by adding towards payments early from the financing identity are able to act as a means to upgrading with the dream domestic.