Purchasing your fantasy house is great but when you do not feel the plan for they you should look at trying to get a home mortgage. How can it be done? Do you have adequate credit score to get a made family to the mortgage? Do you know the standards? Let us plunge when you look at the and you will discuss the adopting the concerns and you will find out the kind of credit scores and not just!

Are manufactured property is a smart selection for home owners trying to find good newly situated progressive household that comes with a realistic price and you can monthly mortgage repayment. The credit score needed for are made home is not different to the latest rating you would need to purchase a timeless household. The difference mainly include certain criteria a cellular family should have.

While a primary-day buyer, it may be a tad bit more difficult to get a better offer and you will home financing package. When you yourself have a successful financing background it helps big go out! If you don’t, you will find financial applications for brand new homeowners and that we’ll discuss lower than!

Just what credit rating is required to pick a made house?. Extremely loan providers want at least credit score off 580 in order to 620 to shop for a cellular house. Usually, 580 ‘s the minimal credit history having are created home loans however, you may still rating investment which have another type of program and lower rating however you could need to make more substantial advance payment for this.

What does a credit history Represent?

A credit rating are a thumb that is short for a person’s creditworthiness. Why don’t we article this is your citation to raised capital in terms to property. Credit ratings are based on various personal economic research. Some of the affairs that will boost your credit rating can getting (using your expense promptly, smaller than average larger loan background and you may money, while others). It’s all according to debt history!

Highest fico scores associate which have ideal creditworthiness. Creditors courtroom people with highest fico scores to own down borrowing exposure and offer them a greater set of borrowing issues at lower interest rates.

Wondering how to purchase a cellular house with poor credit? Well, it would be cash advance in Newbern Alabama very difficult to get the creditors in order to trust your creditworthiness that have a bad credit score however, there can also be be a way that have a more impressive downpayment according to the request!

When you yourself have a bad credit rating you may want to request a professional that can help you that have alternatives towards to get a standard house with less than perfect credit.

Cellular House Conditions to have Mortgage

And, the financing get for a created financial, you would need to ensure that your upcoming family represents next criteria so you can receive a loan because of it.

The are created home will also have to help you be eligible for the borrowed funds. Together with pursuing the HUD’s article-Summer fifteen, 1976, defense laws, the house must:

- It must be real property’ and never personal property’

- Has actually at the very least eight hundred sqft from liveable space

- Feel forever connected with a charity as well as on home you plus individual

Cellular A home loan

Just how to Loans a created Household? Whenever considering the credit history had a need to purchase a made household or perhaps the minimum downpayment getting a cellular household remain in your mind that there exists more issues regarding financing.

- Where do you ever place the house? The loan will likely be toward family simply, so you’ll want to either purchase the residential property for it owing to some other financing. Leasing belongings could imply you will not be eligible for certain funds.

- Bigger homes is almost certainly not qualified to receive specific money To shop for a two fold-wide domestic one to costs $a hundred,100 or higher actually acceptance in the an FHA financing. Maximum loan amounts vary by form of family purchased.

- Compare lenders Not only in the event that you contrast the type of financing, however, observe charges and you will interest rates differ certainly loan providers.

Sort of Mortgage loans to own Are available and you will Mobile Property

There are numerous capital solutions you can favor when purchasing a beneficial are formulated household. Make good credit thereby applying toward most appropriate loans for the coming family!

FHA Mortgage

Supported by the brand new Government Houses Management, FHA funds are very well-known certainly one of earliest-day homebuyers and others looking low down payment home loan possibilities

- FHA Term II money: A down payment as low as 3.5% is needed. Loan terms can be as long as 30 years. Title II loans are real estate loans, meaning you’ll have to purchase the land and home together. The home must be permanently installed on an approved foundation system.

- FHA Identity I loans: These loans are for personal property, so you don’t have to own the land that the home sits on. If the land is leased, the initial lease must be at least three years. Down payments can be as low as 5%. That amount can vary by lender, depending on your credit score.

- Low-down commission criteria

Freddie Mac and Fannie mae

Freddie Mac and you will Federal national mortgage association much more conventional funds having a beneficial fixed-rate mortgage and you may fees for the fifteen, 20, or 3 decades.

Fannie mae fund try acquired through the MD Advantage System, which offers funds within lower costs than antique were created home fund. Certification are starting your house with a driveway. The home need to meet specific construction, design, and you can efficiency standards.

Va Financing

Virtual assistant Home loans are offered because of the private loan providers, such finance companies and mortgage companies. Va finance provide probably the most competitive costs and you will lowest charge in the industry.

USDA Mortgage

A good USDA mortgage try a competitively valued mortgage choice one helps generate to purchase a house less costly to possess low-earnings people living in designated outlying parts. The new You.S. The new Institution out-of Farming backs USDA money in the same manner the brand new Institution regarding Experts Affairs backs Va funds for eligible somebody such as for instance veterans in addition to their family members.

Finance was a very good solutions once you don’t have the finances to buy your dream family right away. This is a good opportunity to obtain it the during the same time. Before taking that loan definitely build a checklist out-of the room funds available and you can browse to discover the best option for your needs.

This can be quite difficult because the capital words and you may paperwork have become tricky. Property Head representatives are taught to help you courtesy each step of one’s funding phase and able to respond to all of the issues you have.

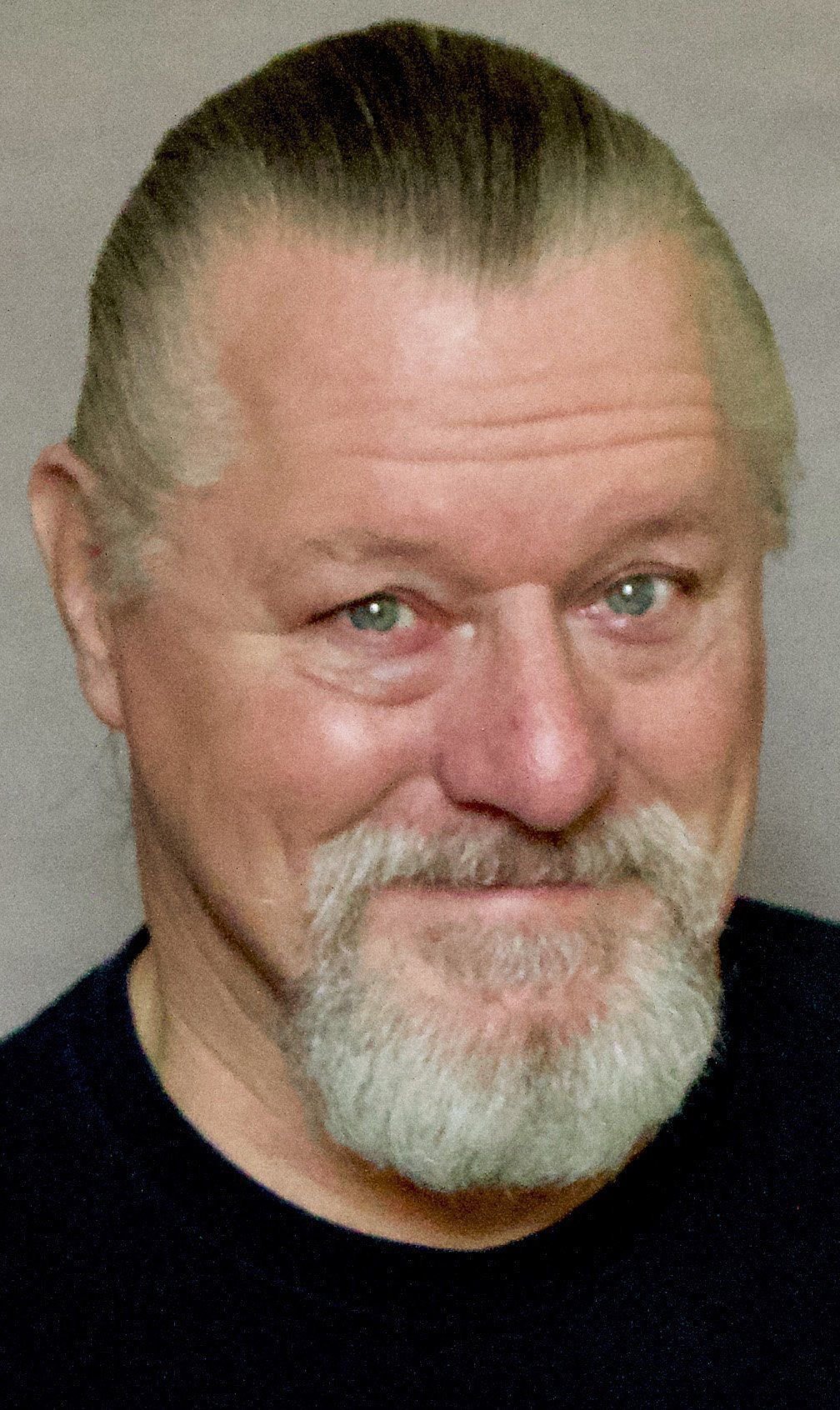

Floyd Pirak

Floyd could have been working for Residential property Lead getting 16 many years since it is Surgery Director nowadays it’s COO helping to manage the places. Ahead of which he is a local Movie director to possess Oakwood Belongings.