The current Coronavirus pandemic makes enough questions regarding the latest affect the real home ily using could possibly offer a great reprieve regarding economic interference for real house buyers. The reason is that multi-family relations properties give shorter chance on account of with several product.

A good number of people don’t discover-is you can pick multiple-family relations attributes that have a great Virtual assistant Mortgage. Its an amazing window of opportunity for knowledgeable traders if not first-day homeowners, so make sure you dont violation it!

Multifamily Land Lookup and Study

When you’re comparing features to get, discover your costs! Your own home loan repayments include dominant, attention, fees, and you will insurance coverage, but that’s never assume all you ought to imagine. You will need to likewise incorporate issues such resources, projected repairs will cost you, vacancy, financing costs, and you may assets administration. That have more than one product mode an increase in each of this type of!

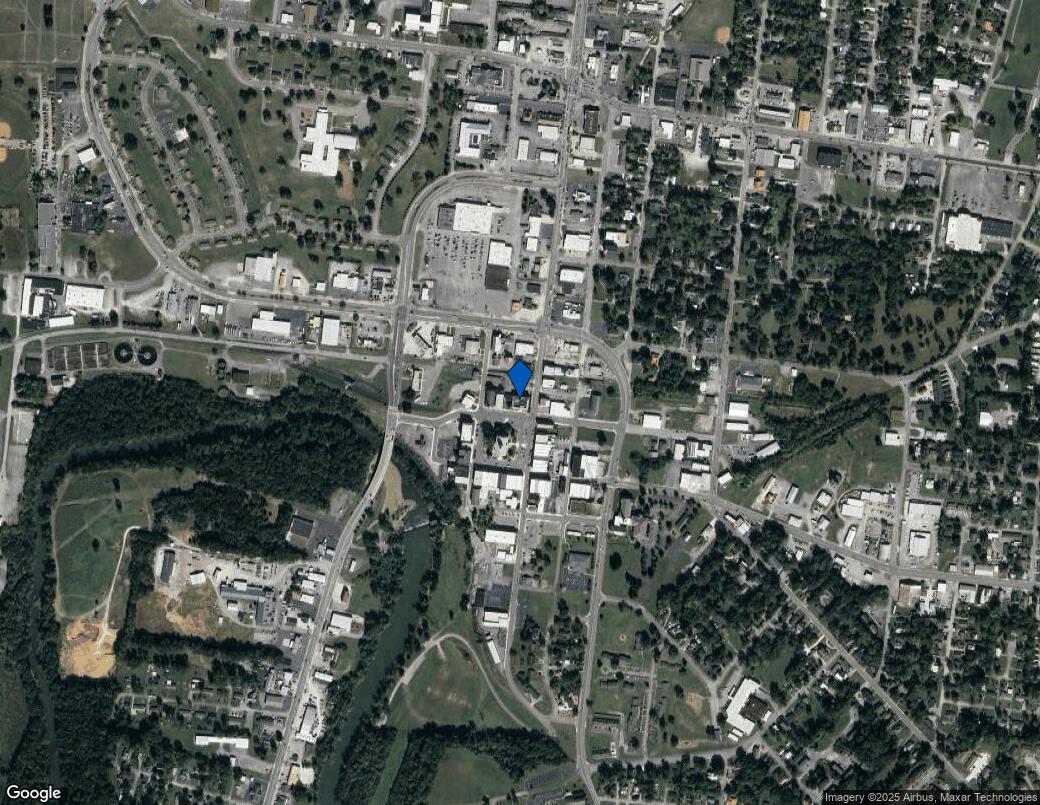

You need to know your possible rents. This will help to you (plus bank) determine if its an excellent get. Place is a big factor in local rental number, so be sure to look urban centers.

Earliest, to invest in a multi-family unit members possessions having a good Virtual https://www.elitecashadvance.com/payday-loans-al/riverside assistant loan, the latest borrower need certainly to take among devices in this two months of closing. Here is the exact same signal that relates to solitary-members of the family residential property. Even if you are required to live on the house, a chance will be based upon renting out of the leftover units to fund the mortgage repayments.

If you have you to seasoned debtor, the property can just only has as much as four gadgets. So, if perhaps you were thinking about starting a Virtual assistant financing to possess good 100-unit apartment advancedthat is not you can, but there is however a method to add more devices. By using a combined Virtual assistant Loan, several experts can find property together. Because it is several borrowers, the newest Va makes it possible for six complete tools. This may involve four residential tools, one to organization device, plus one tool which is joint ownership.

Each typical, the fresh new Va necessitates the property to meet up with minimum possessions standards so you can getting financed. These types of minimal property standards make sure the property is safe and livable. One of these conditions is the fact each device should be personal and you may accessible. Shared liquids, sewer, fuel, and you may strength try okay offered:

- The property has separate service sealed-offs for each equipment.

- You can find easements/covenants protecting drinking water relationships and Va approves of this arrangement.

- Guarantee the devices has legally safe entry to tools having fixes (in the event its passing through-other livings places).

- Shared places for example washing and shops are allowed of the Va.

Virtual assistant Application for the loan Processes for buying Multifamily

Although procedure is going to be similar to playing with good Virtual assistant loan for purchasing one-home, there are several differences. Rather than single-friends, the fresh new Va can allow leasing earnings of vacant gadgets becoming noticed, but you need to prove:

- That you, the borrower, was a skilled landlord/manager on one of those conditions:

- You’ll want owned multifamily prior to now.

- You’ve got prior sense controlling multifamily.

- You really have earlier sense meeting property renting.

- You had been previously useful one possessions character.

Once you’ve provided associated documents to prove one of many above positions, the fresh Va will incorporate 75% of future local rental money on the complete income idea. To utilize coming local rental income, closed leases must be in position ahead of closure the loan.

Most other Factors When buying Multifamily Home which have an effective Virtual assistant Mortgage

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/cmg/X7HIGSQPPJULUWEHPJ3THQ5JQU.jpg)

Even though the price of a multiple-device inspection can be appealing to successfully pass for the, consumers need to have a review done for the property during escrow. With an assessment gives details about any problems with the fresh property, that will help you generate a knowledgeable decision on your buy and might assistance to speed/bargain negotiation.

Making use of your Virtual assistant financing purchasing a multi-nearest and dearest property is an excellent begin or inclusion for the purchasing travels. When you Personal computers to some other duty station, you could rent the systems to create more cash. You could rapidly help make your portfolio and just have reduced financial exposureit’s a victory-earn!

Kelly Madden was an environment Force mate currently stationed at Yokota Abdominal, The japanese and also become married to their own wonderful partner, Rich, for 13 decades. She is also mommy to three breathtaking girls Ava, Lexi, & Evie. A licensed Florida realtor (currently toward referral position), she and her partner individual three rental features in the Crestview, Florida and therefore are performing to the cracking to the multifamily stadium. Kelly likes to invest her date being employed as a virtual assistant, volunteering since the a button lover to have 5AF, and you will horse riding.