I’m a representative and HUD House professional established out of Norman, Oklahoma and you can serving the complete city area as well as Moore, and you can Oklahoma Town. I’ve aided a lot of people (me incorporated) about Norman, Moore, and you will Oklahoma Area town to https://paydayloancolorado.net/la-junta-gardens/ save tens and thousands of dollars by buying home out of HUD. People might think you to definitely to acquire a beneficial HUD home is terrifying — it doesn’t must be, and it also is not to your proper let.

What’s an effective HUD Household? Due to the fact foreclosure techniques could have been accomplished, HUD purchases the brand new homes about loan providers and you will resells all of them as a consequence of the HUD pick program.

Where ought i select HUD Homes for sale for the Norman, Moore, or Oklahoma City? You could potentially see and you can manage your search here.

How to plan an appointment observe good HUD Domestic? Only label (405) 694-8537, and you can tell us the street address of the property you desires to have a look at, and we’ll use all of our special HUD the answer to open new assets for you.

That will purchase a good HUD Domestic? Into help of an effective HUD certified agent, anybody can get a beneficial HUD domestic! As FHA is come to let individuals with owning a home, although not, it preference bidders which might be getting the household just like the a first quarters.

Can HUD shell out closing costs? Yes. Hud can pay regular purchaser’s closing costs to 3.0% of price.

Tend to HUD carry out fixes on domestic? Zero. HUD doesn’t manage one solutions on the house just before or immediately following closure. You must buy the home Just like the-Was.

Should i Use One Bank to purchase an excellent Hud Domestic? Yes, you can utilize any lender, but not, due to the fact HUD purchase procedure is really much diverse from an effective regular family pick, I recommend that you apply an area financial which is used to the fresh new HUD purchase techniques (this is important!).

Ought i nonetheless do Monitors on a beneficial HUD House? Yes. There is the right to carry out inspections on an excellent HUD domestic. HUD offers proprietor occupant bidders a good fifteen time window to help you conduct monitors, assuming there’s something dramatically incorrect toward domestic you to was not revealed inside the HUD’s individual examination (get a hold of less than), you might terminate the newest deal and now have your own serious money back. Getting Investor bidders, you might sagging your serious money if you straight back out-of a beneficial HUD buy for any reason, together with one conditions that come up as a result of inspections.

What are some thing towards Family prior to a keen render? Yes. Hud will always be conduct a review ahead of list the house for-marketing. You will see a full check by going to finding our home, and you will clicking the web link towards intricate listing webpage.

What if the home does not Appraise for the cost? HUD, prior to record our home obtainable, will always has an enthusiastic FHA appraisal over to your property, hence, if you are taking a keen FHA mortgage, tend to stop you from spending on assessment, and take off any queries regarding household maybe not appraising towards the purchase price.

While getting the HUD home with a normal loan, then you’ll definitely have to pay for a supplementary assessment.

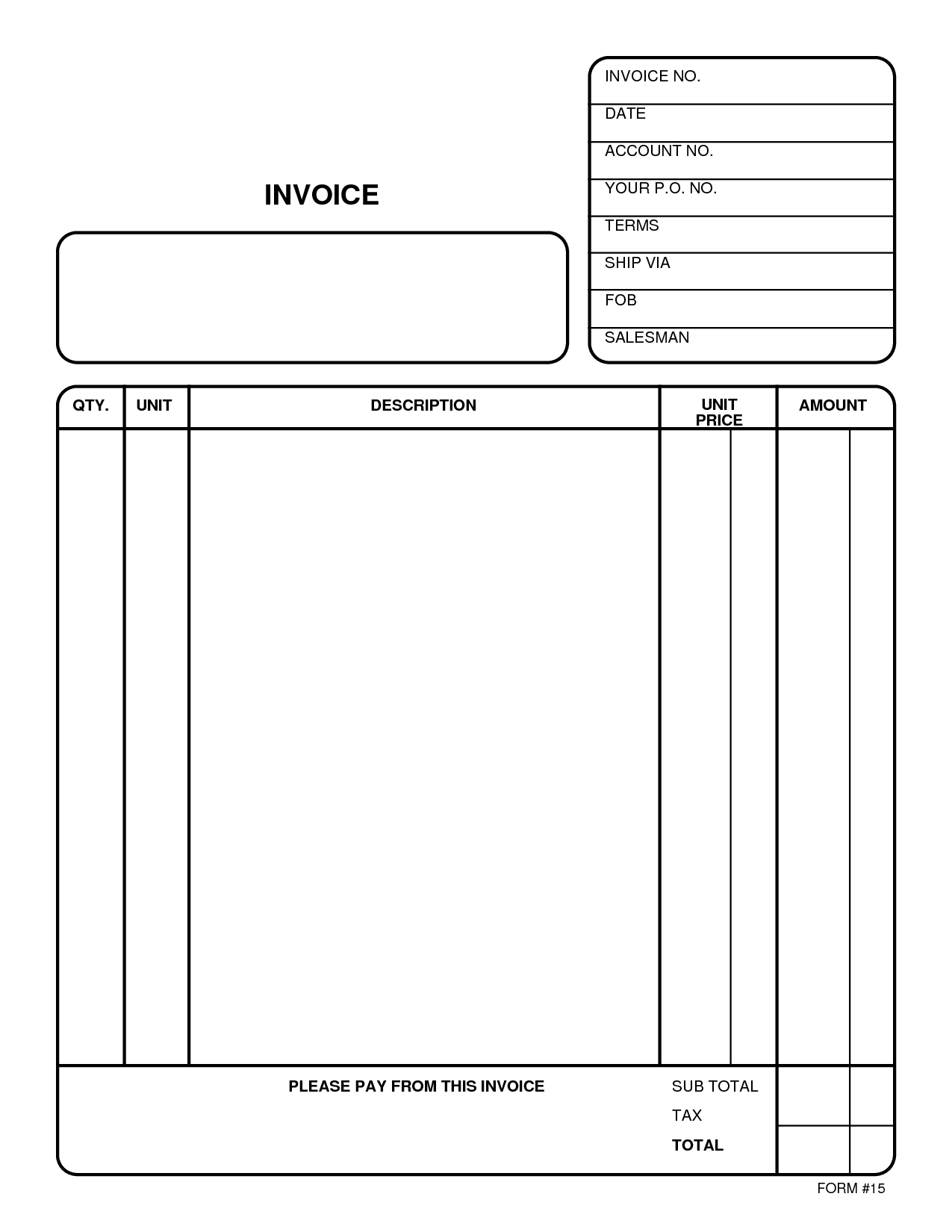

Simply how much serious money am i going to need? Up on and come up with an offer, attempt to has actually a good cashiers seek $five hundred when your price is actually lower than $fifty,000 or $step 1,000 if for example the cost is more than $fifty,001.

When the discover one standards place by your financial, they must be taken into account both as a consequence of escrowing (FHA 203b financing) to the repairs on closure otherwise bringing a specialist FHA 203K loan

Have a lot more questions relating to to order good HUD Domestic into the Norman Okay, Moore Okay, otherwise Oklahoma Area Ok, otherwise do you want me to get in touch with your in the to get a great HUD family? Click the option less than!

A good hud house is a home that has been foreclosed to your, in which the vendor got financing backed by the fresh new Federal Property Management (FHA Loan)

Checklist Articles: Copyright 2024 MLSOK, Inc. record articles is assumed to get perfect it is perhaps not secured. Subject to verification by all people. New checklist pointers being offered is for consumers’ private, non?commercial fool around with and might never be useful people purpose most other than to pick potential functions people are trying to find buying. This record information is copyrighted and you will ed, repurposed, or changed by any means for other site, personal and you will/otherwise objective without any express authored permission from MLSOK, Inc. Suggestions last upgraded on CDT.