Express so it:

- Simply click so you’re able to current email address a relationship to a pal (Opens up when you look at the the fresh new window)

- Mouse click to talk about towards the LinkedIn (Reveals during the the latest screen)

Frost Financial was actually out from the domestic home loan team to own two decades whenever Chairman and you will President Phil Green told his leaders people the amount of time is right to get back from inside the.

However, he wanted they complete the latest Freeze ways, told you Bobby Berman, group government vice-president regarding search and you can method, who had been tasked having strengthening a mortgage service on surface right up.

Now, nearly 24 months shortly after announcing the lender would provide domestic money again, you to this new company is 90 some body good possesses just began moving aside about three mortgage items in San Antonio.

Significantly, filled with precisely what the financial phone calls the Progress home loan, that provides qualified lower-earnings customers the opportunity to fund 100% of one’s price of their residence, has no need for private mortgage insurance rates and you can hides to help you $cuatro,000 to summarize will cost you.

Among the first https://paydayloancolorado.net/dakota-ridge/ grounds we arrived at provide mortgage loans once more are as the i knew there was a space for the affairs having straight down-money individuals, told you Berman, whom registered Freeze for the 1985. The financial institution ultimately will grow the home loan offerings to all or any eight Tx regions where it will providers.

The Advances loan is aimed at Bexar State consumers which build as much as $67,2 hundred, told you a bank spokesman, based on area average earnings just like the computed by the Federal Financial Establishments Examination Council, a company out of financial bodies. For the Sep, that earnings restriction, that’s modified a year, increases so you can $71,280.

One home loan might be popular with an abundance of customers. Median domestic earnings inside the Bexar Condition is more than $62,000, centered on research out of Employees Choice Alamo; more than around three-residence of local home provides yearly profits lower than $100,000.

The fresh new Advances home loan in manners encapsulates brand new Freeze way you to definitely Green looked for, and eschews the fresh new commodification of financial items that assisted force brand new lender from the field to start with.

Relational banking’

Frost is certainly concerned about carrying out strong consumer dating you to enjoys added the lending company so you’re able to their constantly highest buyers maintenance scores. Like, the bank operates a beneficial 24/seven hotline replied by the a frost banker, who can answer customers’ questions regarding its accounts, as well as enable them to discover accounts thereby applying to have money.

Home loan owners will be able to take advantage of that cheer, once the Frost are not bundling and you will offering its mortgages, as is typical, and as an alternative commonly solution all of them into the longevity of the loan, Freeze authorities told you. Simultaneously, the lending company told you they picked to not shell out mortgage loan advisors income with the money it originate to eliminate doing a reward to possess these to force high loan number.

Freeze re-enters the borrowed funds mortgage team in the a difficult time for almost all borrowers. Interest levels recently flower on the high membership since the 2002, plus the supply of existing homes stays rigorous because the owners that have lowest financial cost sit place. The fresh refinancing business also has all but gone away because rates of interest possess risen.

As a result, of many huge banking companies has let go professionals within their mortgage divisions, along with USAA, Wells Fargo and you can Citi, answering a swimming pool of ability to possess Freeze available since occupied its mortgage agencies ranking.

There have been a lot of a beneficial anyone on the market told you Berman, who would like to get on the floor floor at your workplace having a fabulous company that cares from the the anybody.

Financing regularity have continued to help you decline, according to an enthusiastic August questionnaire from the Federal Set-aside Financial regarding Dallas, and therefore noted one bankers mind-set remained cynical.

The fresh San Antonio Board of Realtors reported a beneficial 6% in July report, and a median rates one dipped dos% 12 months over season. Land spent on average 57 days in the industry, a great 104% increase from the prior season.

Generous expansion

Berman recognized the latest fascinating spot house financing is currently when you look at the, and you can said Frost tend to notice very first into the entire big most recent clientele. They rolled out their mortgage activities very first to team, next to help you its Dallas towns for the Summer. San Antonio twigs was basically stored that have educational information just a week ago.

The financial institution is additionally in the course of a hefty expansion. It offers exposed 31 the newest metropolitan areas throughout the Houston region and you can is found on song to include four far more, was halfway thanks to adding 28 brand new twigs throughout the Dallas region and you can established the original of 17 planned this new branches during the Austin earlier this 12 months. They currently contains the prominent Atm network about state.

A subsidiary of San Antonio-depending Cullen/Frost Lenders Inc., Freeze Financial ‘s the biggest regional financial institution located in San Antonio, having 27 branches here and you can intentions to unlock a special venue during the Port San Antonio towards city’s South-side. Since Summer, it had $forty eight.six mil during the property and you can kept $17.six mil inside the funds.

Frost Lender had out of the family lending business inside 2000; during the time, Green asserted that of several things played into the choice, also that all customers shopped to own mortgage loans according to prices instead than on the established banking relationship, long important towards lender.

Becoming outside of the home loan company intended Freeze Lender skirted this new poor of the subprime financial crisis within the 2007 and 2008. It was the original bank, and something regarding not totally all, one to rejected federal bailout fund.

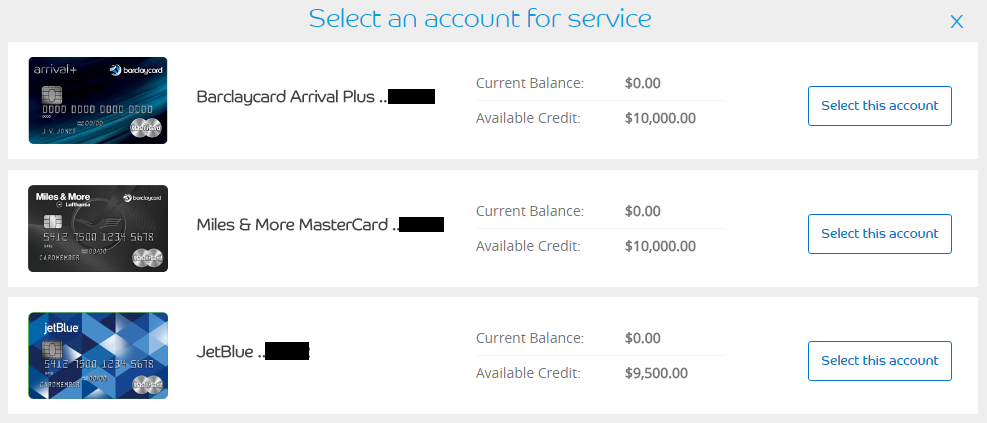

Consumers ended up being requesting mortgages for a time, Berman said, and you will Eco-friendly decided electronic technical was also from inside the a location who does succeed Freeze to make mortgage products which aligned which have their focus on matchmaking banking. Consumers is also securely over apps, upload photographs away from data files and you can sign electronically into dotted range, and also can get a member of staff to walk applicants compliment of the step of processes.

Outside the customers-centric perks, We also thinking about with extremely competitive, if you don’t an educated, costs. And the lower charge, said Berman.

This facts could have been up-to-date to improve you to Freeze Lender get its area median income research for the Progress mortgage throughout the Federal Financial institutions Examination Council.

Frost Lender was an economic recommend of San Antonio Report. To have an entire listing of team people, follow this link.