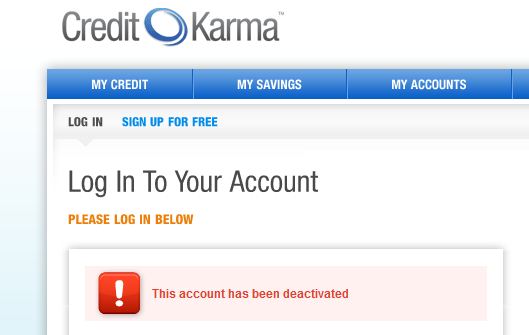

step 1. Look at your borrowing from the bank

All the details thereon declaration can really help you after you talk with their financial manager. It is preferable to take a review of their borrowing once the one year to ensure there aren’t any discrepancies on your declaration.

dos. Rating home loan pre-recognition

Next, choose which mortgage product is a knowledgeable complement your needs, after that store more lenders observe one which has the best terms and conditions. Lenders are for example helpful right here, simply because they work at numerous lenders, and shop your loan around to find the best offer.

Receive your authoritative pre-approval letter demonstrating providers you are a significant client, you’ll want to tell you these types of records:

- 2 years regarding W2s

- Pay stubs over the past a couple months

- Bank statements for the past two months

- Two years worth of taxation statements

- Profit-and-loss statements getting mind-employed individuals

- Bankruptcy proceeding or divorce or separation documentation (if the appropriate)

Acquiring the pre-approval page is a crucial part with the process. It creates any provides generate to your potential homes far more effective, as it implies that debt details have already found the latest lowest requirements required by your own lender, and you can barring one issue throughout the underwriting, you will likely become approved getting financial support.

step 3.Get a hold of a representative

Look for an excellent real estate professional who is competent on functioning which have very first-big date buyers in your area. Their large financial company daily works closely with a great deal of some other agents, and that’s trained on which ones knows your own address community top. First time consumers, veterans, and you may higher-end home buyers will understand this style of experience in settling agreements.

4. Narrow down where you are

Ultimately, first looking, narrow down the space we need to reside in. Imagine activities affected by venue including:

- distance to get results

- just how close you are towards the amenities you like

- top-notch the local colleges (even although you do not have high school students)

- coming improvements or urban area believed

5. Pick the next family

Utilize real estate apps and other useful products in order to remain prepared, and you will look home values in the area. Think of, this will be perhaps not the final home you’ll individual. It is a-start, and you may a means to create your future collateral with the.

Keep your home buying means versus. wants number in your mind even though you store, so you can optimize your buying strength and maintain traditional in view.

six. Build an offer

After you see a house you adore, their representative will assist you to make an offer. The offer will state your own words to the family get, the sort of loan might explore, and you can people supplier concessions you happen to be requesting.

The realtor can help you pick if it is smart to inquire having supplier concessions, whenever it’s a good idea to depart all of them away, according to the heat of market, and you may level of other offers South Carolina installment loans no credit check the home have.

Owner after that has the substitute for take on, deny or bring an effective counteroffer. Usually you will return and you can ahead a few times which have the vendor one which just arrive at an agreement.

7. Their promote is recognized

Once you and also the provider come to a contract plus promote are theoretically approved, youre sensed from inside the price.’ You are going to put a date so you can sign on brand new dotted range and intimate the offer.

8. Loan underwriting and Checks

Now is the time getting underwriting, appraisals, and you can monitors. There’s a lot of waiting around during this time, and it might seem for example you’ll find nothing taking place sometimes, however, much is being conducted behind the scenes to-drive the loan owing to.

TIP: Pose a question to your financial coach regarding the do’s and don’ts off escrow, so you you should never happen to sabotage your home financing through an effective flow their lender would not approve away from.

nine. Personal escrow

Since closure day nears you are going to provide the income for any settlement costs and deposit required by your bank, and you may indication the official paperwork when deciding to take possession in your home.

Once you sign the loan files having a notary, your own financial commonly see people history left requirements and then your file might possibly be put out to number toward condition. While the file was registered with the state, you are theoretically a homeowner!

ten. Plan a consultation.

It is as simple as scheduling an instant telephone call or interviewing a financial advisers. Within a few minutes, you should understand what you can manage, and ways to proceed.