Without having a lot to devote to a down percentage to possess a house, you will be a beneficial meets to possess an FHA financing. The latest Government Houses Government (FHA) backs money to certain highest-exposure applicants as a way to attract more Americans onto the possessions ladder. Sound a?

We know what you are convinced: What does it indicate when you point out that FHA backs such financing? Really, the newest FHA does not commercially act as the lender for your house loan. Instead, they ensure the mortgage. A conventional financial such as a lender will act as the loan servicer-i.e. the one who receives your payment. Thus, you’ll remain writing about antique loan providers, but you will end up being while making a special type of application for the loan-an FHA application for the loan, becoming certain.

Is an applicant for one of those reduced-deposit mortgages, you’ll need to meet a few conditions. They won’t go around handing out FHA funds particularly candy. How do you determine if you meet the requirements? Here is a rundown from FHA official certification.

FHA kits a maximum amount borrowed one varies from condition to state, in line with the price of local property. They have been ranging from $275,000 and you may $650,000, although every now and then the latest restrict is additionally highest.

What is actually your debt-to-money proportion?

Earliest, add up your normal monthly debt obligations-things such as credit cards, student loan payments and you can property money. Once you create these types of calculations, don’t use your existing construction money-use exactly what your payment might be on the new house. The home loan calculator makes it possible to determine what this will feel. Next, separate the number one stands for your own total monthly installments by your disgusting month-to-month earnings. What’s your revenues? It is all the cash you will be making (regarding returns and you can income) ahead of fees. The number you have made after you separate the monthly personal debt from the the terrible monthly income? Which is your debt-to-income proportion. In case it is way too high, you will never be eligible for a keen FHA financing. Exactly how highest is actually highest? The newest number commonly set in stone, but 43% tends to be absolutely the restrict, and it’s really better to strive for 41%.

The debt-to-money proportion just for their houses costs on new house should be no more than 30%. This means that, your disgusting month-to-month earnings multiplied because of the 0.29 translates to new monthly mortgage payment you really can afford, centered on FHA advice. Should your ratio is at or under 31%, you should have a less strenuous big date bringing that loan. Whether your ratio is more than 30%, you are capable of getting the bank in order to flex the brand new regulations, given your whole application implies that you could potentially deal with the borrowed funds repayments. Tend to, when you are examining lenders’ standards you will observe obligations-to-income ratio conditions conveyed inside the sets, towards very first count showing the new proportion for just the construction costs, in addition to 2nd count showing the newest proportion for all the month-to-month expense (, in our example).

How’s your borrowing from the bank?

The state of the credit could be a significant factor during the deciding your own eligibility to own an enthusiastic FHA loan. If you are because of foreclosure over the last 3 years, otherwise bankruptcy during the last a couple of, you would not fulfill FHA qualifications and therefore are perhaps not a candidate for a keen FHA mortgage. So you can qualify for the three.5% advance payment, your credit score must be no less than 580. Having a lower life expectancy score, you will have to put 10% or more down, and you will have trouble interested in a lender who can really works along with you. Usually, the greater your own borrowing from the bank, the greater number of with ease you will be eligible for a mortgage-FHA or otherwise.

Do you put at the least step 3.5% down?

The big advantage of an enthusiastic FHA mortgage is that you can pull off getting as low as step 3.5% off, if in case your credit rating can be snuff. (Compare which to your 20% deposit you’ll need for most antique funds.) An alternative bonus regarding a keen FHA mortgage? Around 100% of FHA downpayment can come away from something special. If you cannot scrape to each other you to definitely step three.5%, even though, you are going to need to waiting and you may save so much more advance payment financing before getting an FHA mortgage.

How’s your own a career records?

Have you ever got 24 months or more out-of steady work? Been with similar boss you to whole date? Lenders want to see one to.

Will our home become your top house?

FHA loans basically commonly available for vacation property, ski chalets, search lodges, seashore shacks, an such like. They’ve been designed to assist individuals fund house that they can live inside the year-bullet.

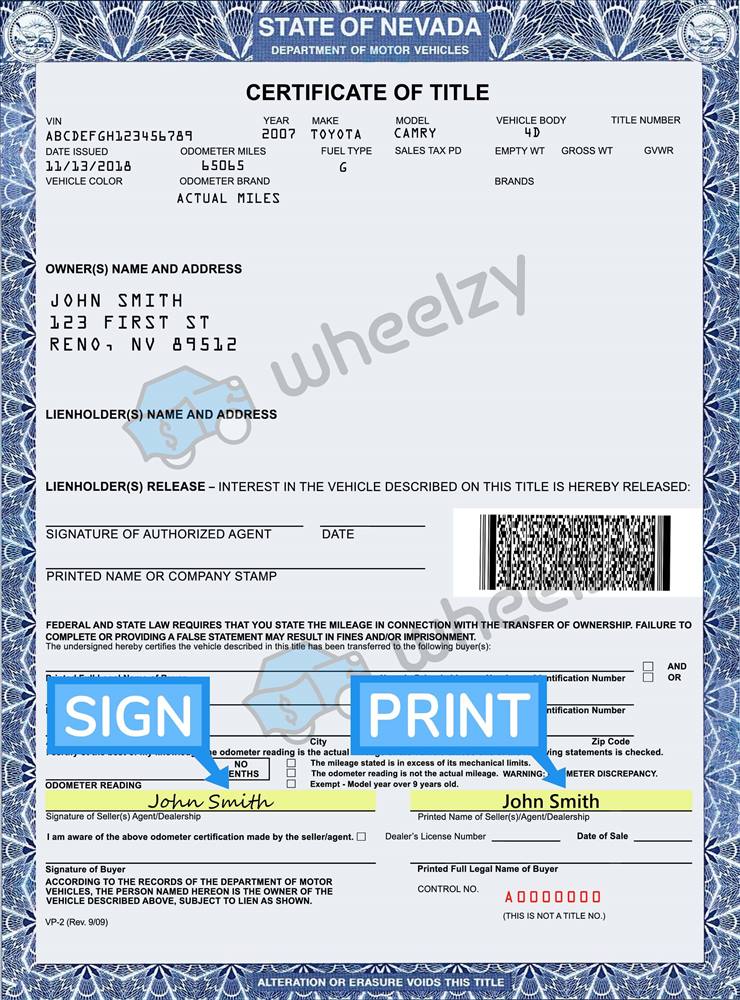

Do you have all of the associated documents?

What forms of some thing how about in order to document? The Social Cover matter, money, most recent address, a career record, lender balance, federal income tax money, people unlock funds and calculate value of your property. And that is a decreased list. You ought to keep in touch with a loan administrator concerning records you are going to need to complete along with your application. Then, initiate looking it-all aside while making duplicates. If you find yourself an experienced, you’ll want to submit additional documentation pertaining to their solution record.

Just remember that , private lenders’ requirements tends to be alot more stringent compared to the FHA certification. When financial institutions want to give FHA loans, they have been permitted to impose their unique requirements beyond those people establish of the regulators. That is why its smart to look available for a lender just before committing to a home loan.

A final situation.

Because your meet the FHA qualifications doesn’t mean simple fact is that most useful kind of financing for you. For people who put less than 10% down to have a keen FHA financing, you will need to shell out financial insurance premiums. Your FHA loan might online payday loans Ellicott Colorado also carry higher interest levels and then make upwards to your low down fee. When you create both of these issues together, you are deciding on a loan which is costlier than a traditional loan might possibly be. In the event your deals getting an advance payment don’t reach the 20% mark constantly required for a normal mortgage, explore advance payment guidance applications otherwise loved ones gifts. Benefiting from down-payment direction to possess a traditional financing will be smaller in the end than simply a reduced-advance payment FHA mortgage. Alternatively, you might hold off on home get and create up your deals and investment. Its worth taking into consideration most of the solutions before making which highest from a decision, and get.