Important: PropStream does not give monetary guidance. This post is having educational purposes simply. Since your house can be used because the equity with some off these loan choice, we recommend speaking with a monetary mentor and/otherwise law firm to make sure you make by far the most educated choice in advance of shifting with some of these financial support solutions.

Given that a bona-fide house buyer, you’re trying to find innovative an easy way to finance your following money spent or upgrade a current that in place of preserving upwards a great large down-payment.

Are you aware that if you currently own a property, you are able to use the collateral of these intentions?

In general, there are around three common sort of financing you to change your property collateral into bucks having an investment property: property equity financing, an excellent HELOC, and you will an other home loan.

What is property Security Mortgage?

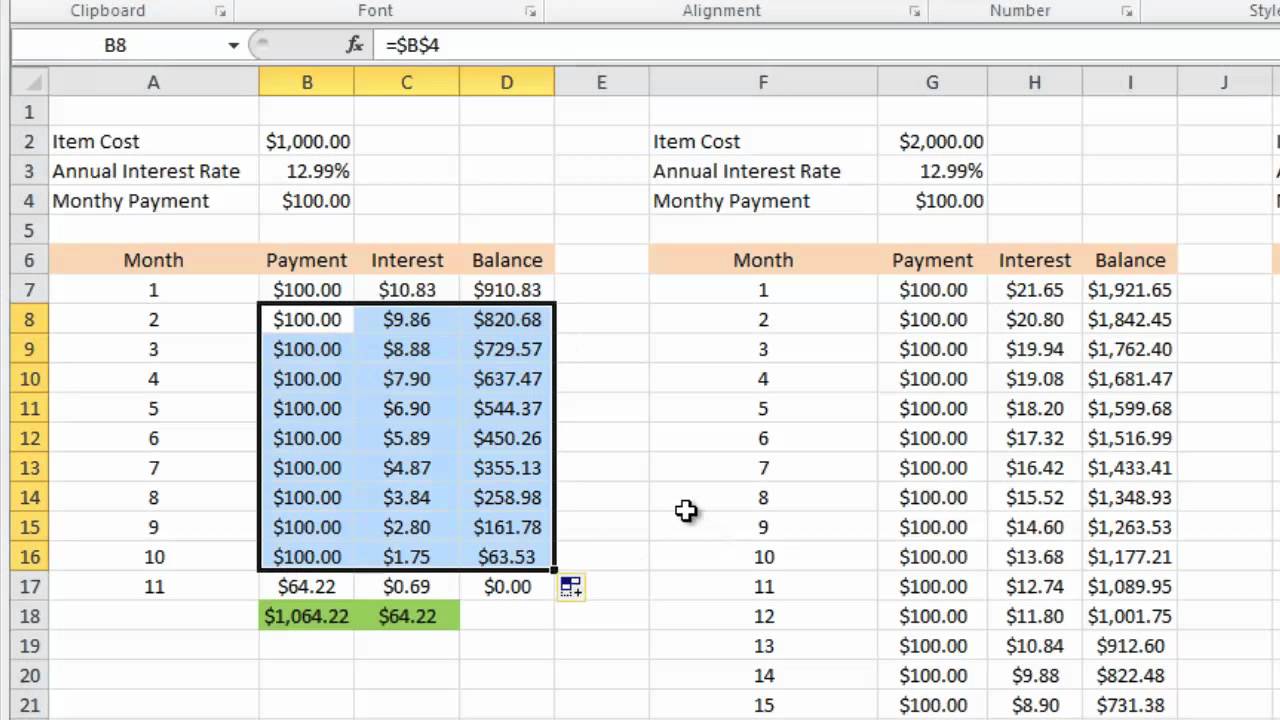

Just like the name suggests, a home equity loan lets you utilize your own security to help you loans instructions. (Security is where far your home is worthy of without having the loans you borrowed on it).

Domestic equity fund are usually called next mortgages because they form similarly to an interest rate. Typically, you will get the cash since a lump sum and pay it off having focus monthly to possess a set name-generally out of five so you can 2 decades or extended.

Like other mortgage loans, domestic collateral loans tend to is appeal, issues, costs, or any other charges. Their interest rates are usually fixed, and thus they stand an equivalent for the whole longevity of the borrowed funds. Specific buyers like such loan from the predictable monthly obligations.

The total amount you could borrow utilizes their lender and your finances. In general, your loan matter is generally simply for 85% of your own equity you may have in your home. After that you can utilize this currency to fund individual expenses, domestic home improvements, or even the acquisition of your following investment property.

Keep in mind that your home will act as equity with this specific sort of loan. So, if you cannot pay the loan, your financial might possibly foreclose on your property.

Family Security Financing Standards

Discover a property collateral loan, you generally need at the very least 20% security on your own property and you will a financial obligation-to-income ratio (their overall month-to-month debt costs divided by the overall month-to-month money) from 43% or less.

Loan providers together with look at your borrowing wellness. You’ll likely need a credit rating of at least 680, according to credit agency Experian . Additional options are around for people with lower fico scores, nevertheless these finance basically include large rates.

- You will get the loan once the a lump sum.

- You might basically merely use as much as 85% in your home collateral.

- Rates and you can commission numbers was repaired.

- You ought to see particular credit and you will earnings conditions so you’re able to qualify.

What is actually a beneficial HELOC?

Such a home collateral financing, a home guarantee credit line (HELOC) lets you make use of the collateral to gain access to liquids cash.

However, in the place of property guarantee financing, a HELOC work similar to a charge card. In the place of choosing the cash since a lump sum, your borrow regarding account as you need around a good preapproved total matter. It matter is dependant on their guarantee, borrowing fitness, and lender. Then you definitely repay everything you use that have interest.

You can eliminate funds from that it membership multiple times, but some HELOCs require that you get it done in this a window of your energy titled a mark several months, and this generally speaking lasts regarding four to help you a decade. Following draw months is more than, you will be in a position to replace the line of credit so you’re able to continue using it.