Shortly after the mortgage acceptance, it’s time to partner which have estate agents just who learn your specific disease. They could support you in finding a property that suits your circumstances and suits affordable. Auctions may make suggestions from to order process, away from to make a deal to discussing terminology. Their systems try indispensable inside the navigating industry post-bankruptcy proceeding.

After you have discovered just the right family, get ready for the mortgage money. This type of money be a little more than paying off the mortgage; they also were notice, taxation, and you will insurance coverage. To manage this type of will cost you effectively, perform a resources you to is the reason their home loan and other way of living costs. Existence on top of your instalments is crucial to have looking after your economic health insurance and strengthening security in your home.

Closing on your own Domestic: What to anticipate

Closure on the house is the very last step-in the house-to invest in process. It phase concerns using closing costs, that may is lender charges, identity insurance rates, and you can appraisal charges. Expertise this type of costs beforehand can prevent any shocks. Your home broker and you may lender will give a closing disclosure document describing this type of expenditures, thus comment they cautiously and have questions if something was unsure.

From inside the closing, additionally signal a number of records, together with your home loan agreement. It is essential to understand this type of files thoroughly before signing. Anyway is signed while the settlement costs was paid down, you will get the new keys to your brand-new house. Well done, you properly navigated your way to help you homeownership just after bankruptcy proceeding!

Keeping Financial Health Shortly after Protecting Your own Financial

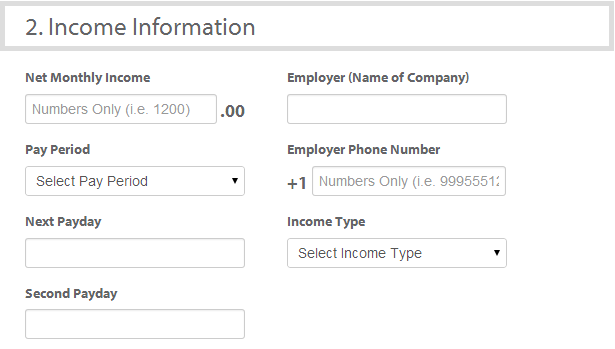

Just after securing your financial, keeping financial health is vital. Home financing calculator will be a very important unit to have controlling their funds. It can help you understand how much you’re going to be using each month and just how people repayments break apart anywhere between prominent, appeal, and escrow. Normal accessibility a mortgage calculator may direct you just how even more payments you’ll shorten the loan term and reduce appeal repaid throughout the years.

You need to continue monitoring your credit rating and you will create your money wisely. End using up excessive a lot more personal debt and keep maintaining rescuing to own emergencies. Existence purchased economic wellness not just assurances you retain their home as well as improves your overall financial situation regarding a lot of time work with.

Conclusion: Looking at a brighter Economic Future

Protecting a home loan immediately following personal bankruptcy may sound overwhelming, nonetheless it opens up the door so you’re able to a better financial upcoming. By the knowing the processes, cautiously believed, and you can getting diligent along with your earnings, you can achieve the newest think of homeownership. Think about, bankruptcy is not the prevent however, an innovative new initiate on the building security and financial security on your own new house.

Because you proceed, remain concerned about debt needs. On a regular basis review your budget, build fast mortgage payments, and you can consistently build your credit. These types of steps can not only secure your financial support payday loans online Montana but also pave the way in which getting upcoming monetary solutions. Homeownership is a huge milestone on the road to recuperation, and with the correct approach, it is within your reach.

Moving forward: Building Guarantee and Economic Protection on your Brand new home

Strengthening collateral of your property begins with typical mortgage payments. For each fee just reduces your loan harmony but also increases their ownership stake. Over the years, since your security develops, your property could become a valuable asset to have future financial need or expenditures. Additionally, keepin constantly your family and you may and then make proper developments is also after that improve their well worth along with your collateral.

Financial security on the brand new home does mean becoming ready to accept the latest unanticipated. Expose an urgent situation loans to pay for unexpected expenses otherwise potential fixes. So it call to action not just handles disregard the in addition to will bring peace of mind since you enjoy your house. Contemplate, strengthening collateral and protecting monetary stability starts with and then make informed decisions and you can staying with your financial package.