It redlining chart regarding Poughkeepsie are among hundreds of Domestic Security Maps away from cities produced by our home Owners’ Mortgage Enterprise (HOLC)

The brand new law established the us Housing Expert (USHA) you to definitely offered $five hundred mil inside loans for reasonable-rates houses methods across the country. In the newest legislation, new USHA acted given that financing granting department to say and you will regional construction authorities to construct reasonable-rates construction in both small and highest urban areas. By the end out of 1940, over 500 USHA systems was indeed happening or is completed, with financing deals of $691 million. The target were to result in the system worry about-sustainable through the type of rents: one-1 / 2 of lease on the renters on their own, one-3rd paid back of the efforts from the National; and one-sixth paid off because of the yearly benefits from the brand new localities by themselves. During The second world war, the fresh new USHA is actually crucial for the think and you will constructing casing to possess security gurus.

An effective Redline As much as Casing Recommendations

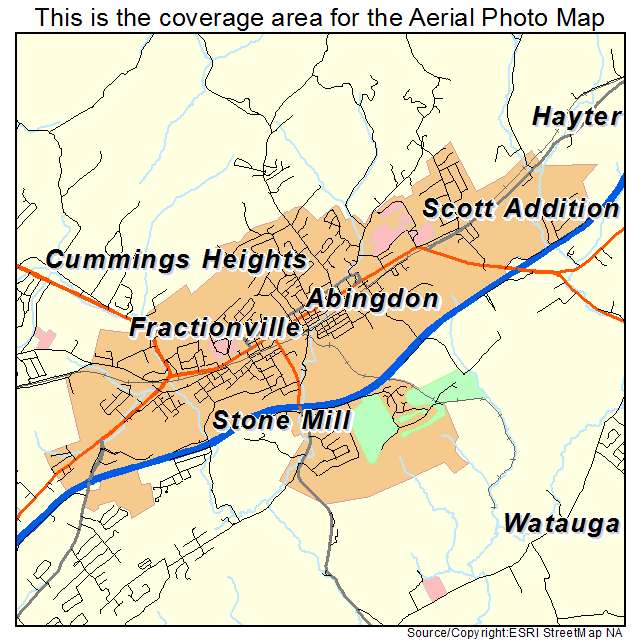

These effort normalized the fresh new housing market and you can offered a path to help you homeownership for years from Us citizens. But bodies financial laws was as well as used to refute loans so you can African People in america and maintain all of them into the segregated areas. New HOLC created color-coded residential defense charts away from numerous towns and cities. The color programming conveyed locations that was deemed safe in order to topic mortgagesmunities that have high African american populations was basically found in parts coded in yellow to possess risky. This type of charts passionate the word redlining-describing a policy out of declining and make federally-covered mortgages in such areas.

From inside the 1935, the FHA provided an enthusiastic Underwriting Manual one to set conditions to own federally recognized mortgages. They endorsed the newest redlining regarding Black residential areas and you will revealed that mortgages really should not be wanted to Black colored household looking to move to the light areas-since FHA was able this should treat property opinions. Just like the Guidelines detailed, in conflict racial teams really should not be allowed to reside in the fresh new exact same organizations. The outcome is actually federal acceptance regarding home-based segregation and personal loans for bad credit Vermont you will assertion out-of opportunities getting Black residents to accumulate generational wide range due to owning a home.

Home-based districts have been noted with assorted tone to point the level of risk during the home loan credit. Roads and you will communities one provided fraction (especially African american) and you may immigrant populations was in fact will noted into the Red because 4th Degree otherwise Hazardous-this new riskiest class getting federally covered resident funds. For example, regarding the Blue city marked B3 with this chart there is certainly a tiny sliver off Red-colored along Glenwood Method. Notes that comes with the fresh map describe as to why: Glenwood Path, which is found within the red-colored, are an old Negro payment before this urban area is actually collected. Similarly, in the Bluish town aker’s cards suggest: Pershing Method (ilies. Properties on this subject roadway have become poor and of absolutely nothing well worth.

So you’re able to Franklin Roosevelt, adequate houses wasn’t only a would like, but the right. Brand new Wagner-Steagall Property Act out-of 1937, with other The brand new Price housing and you may financial efforts, put better economic shelter so you’re able to thousands of Americans. Within his January eleven, 1944 County of one’s Partnership address, FDR proclaimed a good 2nd Bill from Legal rights one to incorporated just the right of every family members so you’re able to a decent home.

FDR next has worked behind the scenes having lawmakers and you can management authorities with the housing expenses. Points instance money regarding strategies, limits with the costs each device, in addition to staffing and you will governance of your own advised construction authority was sorted out inside group meetings stored from the Light Family. On big questions of numerous Congressmen-along with Associate. Steagall-solved, the bill fundamentally decided to go to a vote. Chairman Roosevelt finalized this new Wagner-Steagall Construction Operate to the legislation for the Sep step one, 1937.