Home try a reputable capital choice, evidenced because of the large number of millionaires (90%) with functions in their capital profiles. Yet not, the new entry hindrance is higher, and never we have all the administrative centre to get a property downright. Luckily for us, you’ll find different kinds of mortgage loans within the Maryland; bank loans and you will mortgage lenders are around for those who want to buy a house however, do not have the loans.

A couple of most well known mortgages is actually money spent mortgages and you will antique mortgage loans. This article will explore its differences to aid possessions consumers influence the best option financial for their requires and you will financial predicament.

Exactly what are Conventional Mortgage loans?

Traditional mortgage loans is capital alternatives for someone or household to order an effective number 1 house. These types of money are usually repaid over 15 to 3 decades that have fixed rates. Old-fashioned mortgage loans try backed by the property becoming purchased. If the debtor defaults, the lender can be grab the home due to foreclosures.

Just what are Financial support Mortgage loans?

Resource mortgages are money for buying functions solely for funding aim. This can be getting money age bracket, eg local rental properties and you will trips belongings, otherwise investment like, such as for instance fix-and-flip strategies. Such financing terms can vary. In many cases, a fixed rate loan doing 3 decades remains available.

Down payment

Down payment criteria to have old-fashioned mortgage loans are often a great deal more lenient than simply capital mortgages. This is because lenders glance at resource properties because riskier investment, by way of sector volatility, but number one houses are not somewhat impacted by market fluctuations.

The exact down payment count may differ predicated on issues particularly credit history. Generally speaking, old-fashioned mortgage loans want off money between step 3% in order to 20%, whenever you are investment mortgage loans will get vary from 15% to 25%.

Rates of interest

Rates of interest in the mortgage loans are partially premised to your exposure. So when already centered, money mortgages are thought riskier than just antique mortgage loans. This is why, rates of interest throughout these money were towards higher prevent. This new investor’s credit history and you can financial status also can influence new speed billed to possess often home loan.

Eligibility Requirements

Brand new qualification requirements to own financial support mortgages was strict compared to the old-fashioned mortgages. To own old-fashioned mortgages, lenders generally use credit score, debt-to-earnings ratio, and you can a position history to decide a good borrower’s creditworthiness. Individuals taking right out a good investment home loan need certainly to establish their capability to cover home loan repayments as a consequence of rental income as well as their expertise in a property spending, as well as the standards mentioned above.

Chance Circumstances Associated with Each kind of Financial

Antique mortgages bring a serious risk when removed to finance a purchase within the an extremely unpredictable business. The latest debtor might end up with bad guarantee, where they owe over the value of their house. This would allow it to be difficult to offer the home and you can clear the loan loans with the proceeds or perhaps to re-finance, should the you would like develop.

Financial support mortgages are also higher-exposure since their efficiency, or run out of thereof, are tied to the efficiency of real estate market. A beneficial downturn in the market would decelerate money age bracket, which could apply to repayment. Extended vacancies also can reduce the investor’s capability to pay back the latest financing.

Factors to consider When choosing Ranging from Resource Mortgage loans and Antique Mortgage loans

Choosing between the two home loan products comes down to the brand new required explore. A vintage home loan could have ideal loan conditions minimizing focus prices but could just be useful for proprietor-occupied qualities. Buyer mortgages is tailored for money-promoting characteristics.

But not, you can find instances when each other selection might be practical, instance house hacking, the acquisition away from trips homes, and mixed-use properties. This kind of problems, the fresh new debtor is to measure the monetary reputation. A timeless mortgage is best in case your borrower’s credit history, a career records, and loans-to-income proportion was strong.

Remember that for some fool around with times, new borrower can take aside an investor financial and later transfer it to help you a classic home loan. They truly are:

Household flipping: An investor can first get a financial investment home loan to order an effective property so you’re able to renovate and you may quickly resell they to possess money but later intend to hold they. That assets do be eligible for a classic financial.

Travel local rental assets: Furthermore, a trader get borrow a keen investor’s mortgage to purchase property that have vacation rentals in your mind. As long as they decide to follow the home for personal play with later on, they can convert the mortgage in order to a traditional home loan.

Owner-occupied duplex otherwise multiple-family assets: An individual can pick a multiple-tool possessions while the a good investment however, later decide to consume you to definitely of systems. In this case, the present day individual mortgage shall be changed into a vintage financial.

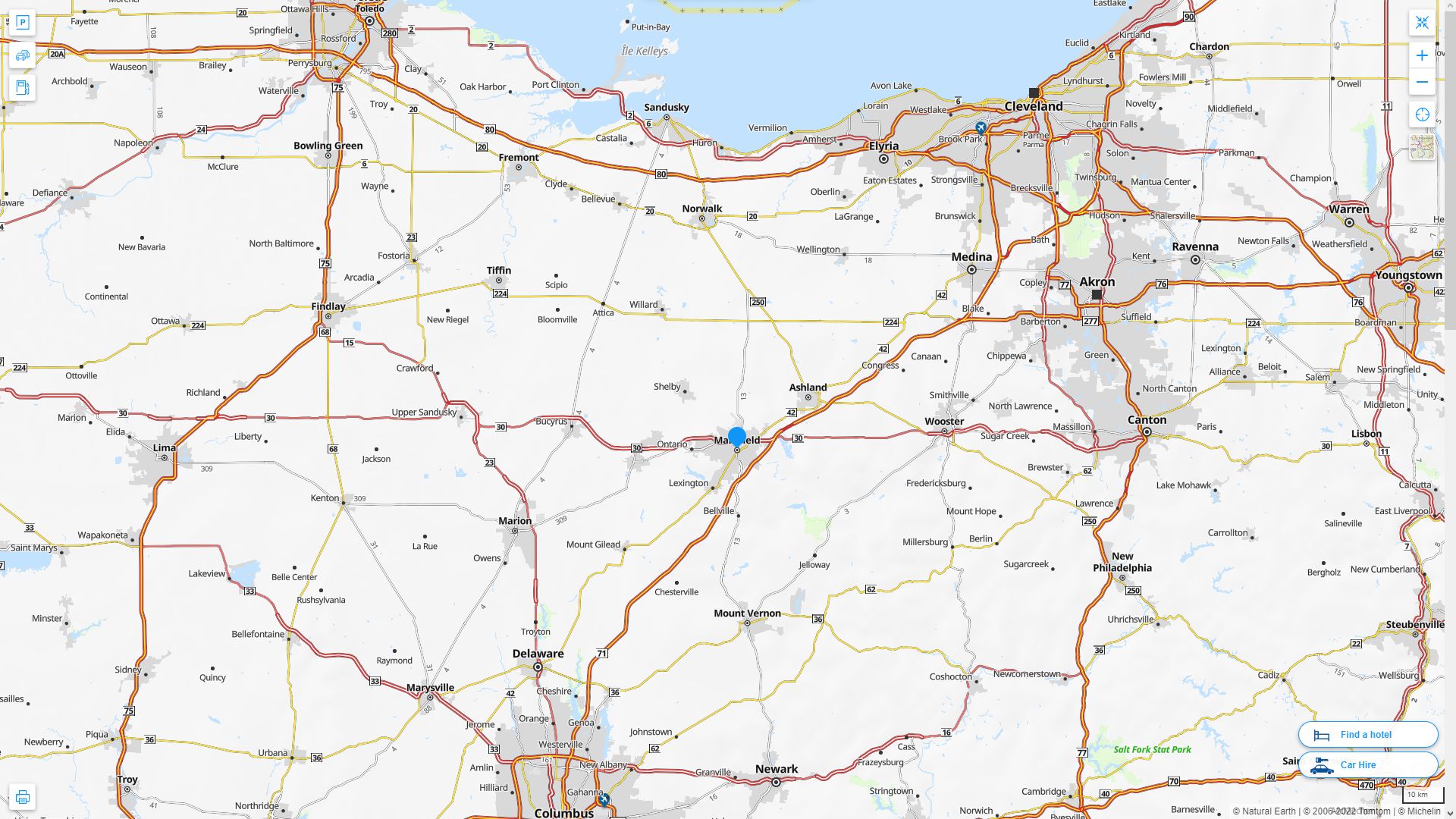

Speak about Maryland Mortgage Selection principal site Which have Woodsboro Bank

Woodsboro Lender offers individuals home loan choices for homebuyers and people inside Frederick County, Maryland, and you can surrounding section. This type of mortgage loans is having first-time homebuyers otherwise educated a residential property traders seeking create, purchase, otherwise refinance a house. Woodsboro Lender even offers HELOC, FHA, and you can variable-speed mortgages. Contact Woodsboro Bank right now to discuss Maryland mortgage alternatives.