Some personal debt is suitable when selecting a property, however it could affect what you can do to acquire home financing. Whenever evaluating your own home loan software, loan providers will look at your financial obligation-to-earnings (DTI) proportion and you will credit history, thus try using a powerful DTI out of 43% or reduced and you may good to higher level borrowing from the bank.

In this article:

Not all loans try “bad” personal debt. Most of us most likely are unable to pick a property or visit school instead trying out particular personal debt. But if you haven’t purchased a property and you can create however particularly in order to, which have a good number of debt isnt most readily useful. A massive percentage of a lender’s decision to approve your financial depends on determining though you really can afford to blow they back. While you are stuck having debts, the brand new monthly payments your already owe will make challenging to help you meet a home loan percentage every month.

And you may considering the fact that 80% off Us citizens have been in debt, at the an average amount of $90,000, it’s reasonable so you can ponder whether or not financial obligation have a tendency to prevent you out-of to find a house.

That being said, it is far from impractical to get a home while you are with debt. If you find yourself willing to stop leasing but you are concerned about how far loans you’ll have when buying property, continue reading, as the we will make it easier to learn to take action.

Do you need a mortgage?

Oftentimes, you’ll need a mortgage to invest in a house. A mortgage are that loan that assists your funds your residence purchase. Permits you to get the bucks you should done a property buy in exchange for monthly obligations having notice up to you have to pay off of the financing otherwise offer the home.

Unless you have the h2o cash to order property downright or is also make adequate profit from a previous home marketing to loans your next family buy, needed home financing. (If you do have the cash offered to purchase a house outright, you don’t need to love your debt affecting home financing — so you can forget this article.)

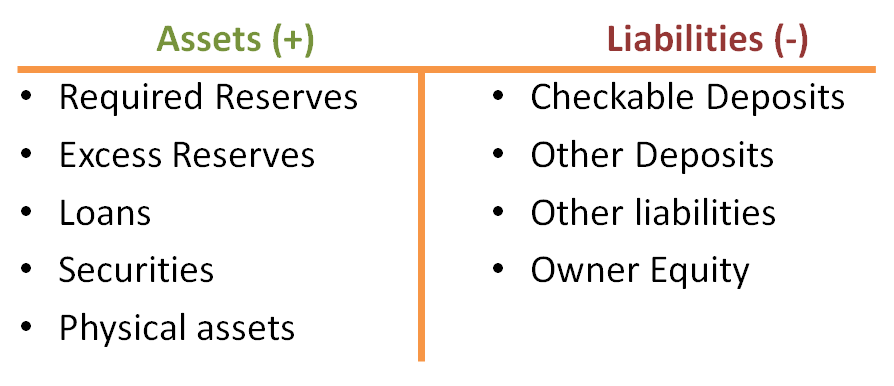

No one or two lenders will get an identical conditions to own approving a financial, thus there’s no one right way to respond to this concern. Every thing boils down to risk and how most likely youre to invest the borrowed funds right back. Extremely loan providers will at around three chief standards on your own your mortgage software:

- Debt-to-income proportion (DTI)

- Credit history

- Assets

This type of around three conditions assist a financial top learn the money you owe and watch a price it seems comfortable loaning for your requirements. If you can generate a bigger advance payment, the bank will get financing your more funds. If you have increased credit score and have found an ability to pay off their consumer debt (personal credit card debt) monthly, the lending company can get agree a much bigger financial.

Exactly how much personal debt would you provides but still qualify for a financial?

Your DTI ratio is the percentage of your gross monthly money which is dedicated to paying expense. Possibly more other metric, here is the most critical number when it comes to bringing recognized to own a home installment loans Wisconsin loan.

Considering Investopedia, loan providers desire see a financial obligation-to-money proportion smaller compared to thirty six%, and more than does not accept your application in case the DTI ratio exceeds 43%.

- FHA fund constantly require an effective DTI ratio off 45% or less.

- USDA money require an effective DTI proportion out of 43% or reduced.

- Traditional home mortgages wanted a beneficial DTI ratio of forty-five% or less.

Calculating your debt-to-earnings ratio

Can you imagine you create $50,000 a year. Divide you to number by several (because the which is exactly how many months you can find when you look at the a year) to have a gross monthly income of approximately $cuatro,166.

Add up your financial situation, along with automobile costs, credit card money, education loan repayments, chairs funding costs — everything you pay every month in order to a financial institution. (For those who actually have home financing, through the entire mortgage payment, and additionally possessions taxes and you may insurance rates costs.)

State the whole of these amounts are $step 1,800. Split one of the $cuatro,166 for a great DTI proportion of 43.2%. This is the extremely high avoid of the range you to definitely a lender you are going to approve your financial, very you’ll possess a far greater likelihood of financial approval with an effective large credit score otherwise enough liquid assets and also make a much bigger down-payment. Otherwise, it is the right time to reduce your DTI proportion.