If you are an eligible seasoned or servicemember given good Virtual assistant domestic mortgage, you’ve got heard cam of a pest evaluation specifications. However, as to the reasons you’ll the brand new Service out-of Pros Circumstances (VA) require a termite inspection and just how does the procedure works? Whether you’re selling or buying a home, this is what you must know in the pest inspections to possess Va money.

What is actually an effective Virtual assistant loan pest examination?

A Va termite review may be needed while you are buying a great house with a Va financing. For the a termite assessment, a qualified elite explores the home for bugs and signs of timber ruin. This will be to ensure the cover and ethics of the house.

Remember that pest inspections having Virtual assistant loans may go by a number of names. You can even locate them referred to as WDO (wood-damaging organism) otherwise WDI (wood-damaging insect) monitors. Fitted, considering the military’s affection having acronyms.

Why is a termite assessment called for?

In addition to being a pain in the neck, termite destroy will likely be expensive. Slight destroy can sometimes be repaired relatively affordably, however, large infestations could cost way more to alleviate. Termite infestations have the possibility to help you affect the property value a home or even managed.

Is actually an excellent Virtual assistant financing pest review required in most of the county?

As the termites be prominent in some areas of the latest You.S. than others, pest evaluation requirements will will vary from the condition, if not from the condition. More over, these conditions is susceptible to changes, so it is basically value doing your research to determine which standards affect Virtual assistant money near you.

No matter area, a beneficial Va termite check is almost always needed in the event that proof of wood-damaging damage from insects are detailed regarding the separate appraisal the Va by themselves need.

Why does brand new Virtual assistant determine which components wanted termite checks?

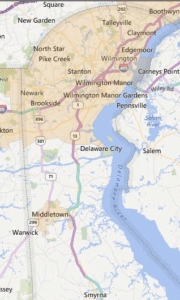

The brand new Va hinges on what’s titled a pest Infestation Probability Chart, indicating and this places in the us is most likely to termites. That it map is actually periodically upgraded, and checks are generally necessary for one components which have a beneficial reasonable so you can heavy or most heavy likelihood of termite infestation. A full range of states and you may areas which need termite checks can be found to the Va site.

Further exclusions having Virtual assistant termite inspections

While many says require termite monitors having Virtual assistant funds, they’re not required for everyone Va financing activities. Such as, pest checks generally speaking commonly required for Virtual assistant streamline funds, also known as IRRRLs (Rate of interest Avoidance Re-finance Fund), a loan merchandise that will build refinancing less and a lot more reasonable having pros.

Va pest evaluation versus. Va appraisals

Virtual assistant pest monitors shouldn’t be confused with Va appraisals. A great Virtual assistant assessment, you’ll need for the Va loan buy, is actually a standard review off an effective home’s well worth and position transmitted out-by another appraiser authorized by the Virtual assistant.

Exactly who pays for a good Virtual assistant termite review?

It once was that people who get a home that have a good Va mortgage have been typically banned from paying for the fresh new termite evaluation on their own.

not, Va pest assessment requirements have been loosened when you look at the 2022 allowing every individuals to pay for inspections. Which change are partially on account of concerns one demanding sellers in order to pay for this new termite evaluation are a possible cause of rubbing from inside the purchasing techniques. The cost of inspections basically may vary because of the sized the fresh new house and just how comprehensive the new evaluation is.

How does an excellent Virtual assistant termite evaluation really works?

Inside the a termite examination to have an effective Va loan, a professional inspector check outs the home and you may explores its outside and you can, available aspects of the interior, and attics and you can examine room. New inspector looks for signs and symptoms of timber-damaging bugs such as termites and you will carpenter ants. Cues could include pest sightings, wood damage in the or just around the property and you will bug droppings.

A pest check to own a great Va loan will typically find more than just termites, however for all bugs. New Virtual assistant insect evaluation may be limited by people insects and that bring about wood destroy, instance termites, powderpost beetles, carpenter bees and carpenter ants. Although not, in the event the inspector notices other difficulties, particularly a problem with almost every other bugs or with rats, they might suggest that it regarding the statement, also any features that could result in the possessions vulnerable to infestation.

Termite home inspections are appropriate to own ninety days, enabling the consumer time to finish the closure techniques. Remember that that it legitimacy window is actually for the brand new Va loan procedure and will not make sure bugs won’t arrive in our house amongst the check plus disperse-for the go out. This structure of the inspector’s report can differ because of the condition.

What will happen if a house fails its Virtual assistant pest check?

In the event the property you need to pick fails the Virtual assistant termite inspection, the issue must be handled. This new evaluation statement tend to has information and you can recommendations of procedures.

As for just who assumes on the newest fix rates, this can will vary because of the state. In a few says, it could be as much as the customer, while almost every other claims might need sellers or loan providers to help you contribute right up so you can a specific amount. Anyhow, the fresh Virtual assistant prompts the consumer to help you negotiate towards provider more repair costs.

Bottom line

The goal of Va mortgage brokers will be to help offer safer and you may hygienic houses having services professionals, pros and you will eligible survivors. In the areas where infestations are typical, a great Virtual assistant mortgage pest evaluation is typically necessary to guarantee that the house is free of charge off potentially expensive bugs Scottsboro cash advance. Given that requirements may differ by county, it’s value taking a look at the Va webpages otherwise conversing with their real estate professional to determine if termite monitors are required getting Virtual assistant money close by.